Difference between revisions of "Ukie UK Consumer Games Market Valuation"

m (→About UKie's UK Consumer Market Valuation: typo) |

(→Game Software) |

||

| (35 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

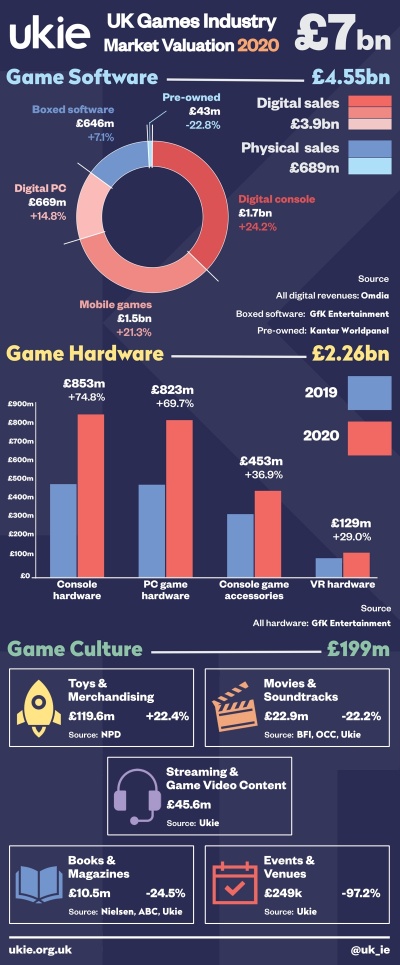

| + | [[File:Ukie UK Games Industry Market Valuation 2020 800px.jpg|thumb|border|400px|Ukie 2020 UK Consumer Games Market Valuation]] | ||

| + | |||

== About Ukie's UK Consumer Market Valuation == | == About Ukie's UK Consumer Market Valuation == | ||

Every year, Ukie work with industry data partners to produce a valuation of UK consumer spend on games and game-related products. | Every year, Ukie work with industry data partners to produce a valuation of UK consumer spend on games and game-related products. | ||

| − | == | + | == Annual UK Consumer Market Valuations == |

| − | + | *[[2020 UK Consumer Games Market Valuation]] | |

| + | *[[2019 UK Consumer Games Market Valuation]] | ||

| + | *[[2018 UK Consumer Games Market Valuation]] | ||

| + | *[[2017 UK Consumer Games Market Valuation]] | ||

| + | *[[2016 UK Consumer Games Market Valuation]] | ||

| + | *[[2015 UK Consumer Games Market Valuation]] | ||

| + | *[[2014 UK Consumer Games Market Valuation]] | ||

| + | *[[2013 UK Consumer Games Market Valuation]] | ||

| + | *[[2012 UK Consumer Games Market Valuation]] | ||

| − | + | == Summary of Valuations to Date == | |

| − | + | Please note that each year, percentage growth is calculated from a revised estimation of the previous year to ensure consistency of measurement. Therefore growth amounts shown for each year may not directly correlate with the amounts shown in the official numbers for each year listed. Both reported and revised figures are provided for the most recent year in the tables below to demonstrate. | |

| − | + | === Annual Totals === | |

| − | + | {| class="wikitable" | |

| + | |'''Year''' | ||

| + | |'''Total Spend ''' | ||

| + | |'''% Growth''' | ||

| + | |- | ||

| + | |2020 | ||

| + | |£7.0bn | ||

| + | | +29.9% | ||

| + | |- | ||

| + | |2019 (revised) | ||

| + | |£5.39bn | ||

| + | | | ||

| + | |- | ||

| + | |2019 | ||

| + | |£5.35bn | ||

| + | | -4.8% | ||

| + | |- | ||

| + | |2018 | ||

| + | |£5.7bn | ||

| + | | +10.0% | ||

| + | |- | ||

| + | |2017 | ||

| + | |£5.11bn | ||

| + | | +12.4% | ||

| + | |- | ||

| + | |2016 | ||

| + | |£4.33bn | ||

| + | | +1.2% | ||

| + | |- | ||

| + | |2015 | ||

| + | |£4.19bn | ||

| + | | +5.3% | ||

| + | |- | ||

| + | |2014 | ||

| + | |£3.94bn | ||

| + | | +14.6% | ||

| + | |- | ||

| + | |2013 | ||

| + | |£3.48n | ||

| + | | +19.9% | ||

| + | |- | ||

| + | |2012 | ||

| + | |£3.27bn | ||

| + | | | ||

| + | |} | ||

| − | + | === Game Software === | |

| − | + | In 2020, the previous category of Digital & Online was split into the component parts of Digital Console and Digital PC. In the same year, new totals were also introduced for the combined digital and physical sales markets. | |

| − | + | {| class="wikitable" | |

| + | |rowspan="2"|'''Year''' | ||

| + | |colspan="2"|'''Digital & Online''' | ||

| + | |colspan="2"|'''Digital Console''' | ||

| + | |colspan="2"|'''Digital PC''' | ||

| + | |colspan="2"|'''Mobile Games''' | ||

| + | |colspan="2" style="background-color:LightGrey"|'''Combined Digital Sales''' | ||

| + | |colspan="2"|'''Boxed Games''' | ||

| + | |colspan="2"|'''Pre-Owned''' | ||

| + | |colspan="2" style="background-color:LightGrey"|'''Combined Physical Sales''' | ||

| + | |- | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |style="background-color:LightGrey"|'''Spend''' | ||

| + | |style="background-color:LightGrey"|'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |style="background-color:LightGrey"|'''Spend''' | ||

| + | |style="background-color:LightGrey"|'''% Growth''' | ||

| + | |- | ||

| − | + | |2020 | |

| + | | | ||

| + | | | ||

| + | |£1.7bn | ||

| + | | +24.2 | ||

| + | |£669m | ||

| + | | +14.8 | ||

| + | |£1.5bn | ||

| + | | +21.3% | ||

| + | |'''£3.9bn''' | ||

| + | | '''+21.4%''' | ||

| + | |£646m | ||

| + | | +7.1% | ||

| + | |£42.6m | ||

| + | | -22.8% | ||

| + | |'''£689m''' | ||

| + | | '''+4.6%''' | ||

| + | |- | ||

| + | |2019 (revised) | ||

| + | | | ||

| + | | | ||

| + | |£1.4bn | ||

| + | | | ||

| + | |£582m | ||

| + | | | ||

| + | |£1.2bn | ||

| + | | | ||

| + | |'''£3.2bn''' | ||

| + | | | ||

| + | |£603m | ||

| + | | | ||

| + | |£55.3m | ||

| + | | | ||

| + | |'''£658m''' | ||

| + | | | ||

| + | |- | ||

| + | |2019 | ||

| + | |£1.98bn | ||

| + | | +0.6% | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£1.21bn | ||

| + | | +7.7% | ||

| + | | | ||

| + | | | ||

| + | |£603m | ||

| + | | -21.7% | ||

| + | |£55.2m | ||

| + | | -18.7% | ||

| + | | | ||

| + | | | ||

| + | |- | ||

| + | |2018 | ||

| + | |£2.01bn | ||

| + | | +20.3% | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£1.17bn | ||

| + | | +8.2% | ||

| + | | | ||

| + | | | ||

| + | |£770.0m | ||

| + | | -2.6% | ||

| + | |£67.9m | ||

| + | | -30.8% | ||

| + | | | ||

| + | | | ||

| + | |- | ||

| + | |2017 | ||

| + | |£1.6bn | ||

| + | | +13.4% | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£1.07bn | ||

| + | | +7.8% | ||

| + | | | ||

| + | | | ||

| + | |£790.5m | ||

| + | | +3.1% | ||

| + | |£101.1m | ||

| + | | -15.1% | ||

| + | | | ||

| + | | | ||

| + | |- | ||

| + | |2016 | ||

| + | |£1.22bn | ||

| + | | +11.1% | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£955.1m | ||

| + | | +16.9% | ||

| + | | | ||

| + | | | ||

| + | |£766.7m | ||

| + | | -15.2% | ||

| + | |£119 | ||

| + | | -3.3% | ||

| + | | | ||

| + | | | ||

| + | |- | ||

| + | |2015 | ||

| + | |£1.224bn | ||

| + | | +13.2% | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£664m | ||

| + | | +21.2% | ||

| + | | | ||

| + | | | ||

| + | |£904m | ||

| + | | -3.0% | ||

| + | |£123m | ||

| + | | +9.3% | ||

| + | | | ||

| + | | | ||

| + | |- | ||

| + | |2014 | ||

| + | |£1.048bn | ||

| + | | +17.6% | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£548m | ||

| + | | +21.2% | ||

| + | | | ||

| + | | | ||

| + | |£935m | ||

| + | | -6.3% | ||

| + | |£106.8m | ||

| + | | +10.7% | ||

| + | | | ||

| + | | | ||

| + | |- | ||

| + | |2013 | ||

| + | |£819m | ||

| + | | +25.0% | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£430m | ||

| + | | +83.0% | ||

| + | | | ||

| + | | | ||

| + | |£998m | ||

| + | | -5.0% | ||

| + | |£78m | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |- | ||

| + | |2012 | ||

| + | |£520 | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£158m | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£1.42bn | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |} | ||

| − | === Game | + | === Game Hardware === |

| − | Game- | + | {| class="wikitable" |

| + | |rowspan="2"|'''Year''' | ||

| + | |colspan="2"|'''Console Hardware''' | ||

| + | |colspan="2"|'''PC Game Hardware''' | ||

| + | |colspan="2"|'''Peripherals & Accessories''' | ||

| + | |colspan="2"|'''VR Hardware''' | ||

| + | |- | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |- | ||

| + | |2020 | ||

| + | |£853m | ||

| + | | +74.8% | ||

| + | |£823m | ||

| + | | +69.7% | ||

| + | |£453m | ||

| + | | +36.9% | ||

| + | |£129m | ||

| + | | +29.0% | ||

| + | |- | ||

| + | |2019 (revised) | ||

| + | |£488m | ||

| + | | | ||

| + | |£485m | ||

| + | | | ||

| + | |£331m | ||

| + | | | ||

| + | |£100m | ||

| + | | | ||

| + | |- | ||

| − | |||

| − | |||

| − | + | |2019 | |

| − | + | |£488m | |

| − | + | | -30.5% | |

| − | + | |£469m | |

| − | + | | +6.1% | |

| − | | | + | |£331m |

| − | | | + | | -6.8% |

| − | | | + | |£65.8m |

| − | | | + | | -12.0% |

| − | | | + | |- |

| + | |2018 | ||

| + | |£702.0m | ||

| + | | +6.5% | ||

| + | |£445.0m | ||

| + | | +18.4% | ||

| + | |£355.0m | ||

| + | | +19.9% | ||

| + | |£72.0m | ||

| + | | -20.9% | ||

|- | |- | ||

| − | | | + | |2017 |

| − | | | + | |£659.3m |

| − | |1 | + | | +29.9% |

| − | | | + | |£376m |

| − | | + | + | | +51.0% |

| + | |£296.1m | ||

| + | | -1.4% | ||

| + | |£100.8m | ||

| + | | +23.5% | ||

|- | |- | ||

| − | | | + | |2016 |

| − | | | + | |£507.5m |

| − | | | + | | -26.7% |

| − | | | + | |£258m |

| − | | +3. | + | | +64.3% |

| + | |£300.1m | ||

| + | | -16.6% | ||

| + | |£61.3m | ||

| + | | | ||

|- | |- | ||

| − | | | + | |2015 |

| − | | | + | |£689m |

| − | | | + | | -24.7% |

| − | | | + | |£138m |

| − | | + | + | | |

| + | |£360m | ||

| + | | +24.6% | ||

| + | | | ||

| + | | | ||

|- | |- | ||

| − | | | + | |2014 |

| − | | | + | |£915m |

| − | | | + | | +42.6% |

| − | | | + | | |

| − | | | + | | |

| + | |£288m | ||

| + | | +4.3% | ||

| + | | | ||

| + | | | ||

|- | |- | ||

| − | | | + | |2013 |

| + | |£626m | ||

| + | | +38.0% | ||

| + | | | ||

| + | | | ||

| + | |£424m | ||

| + | | +1.0% | ||

| + | | | ||

| | | | ||

| − | |||

| − | |||

| − | |||

|- | |- | ||

| − | | | + | |2012 |

| − | | | + | |£453m |

| − | | | + | | |

| − | | | + | | |

| − | | | + | | |

| + | |£646m | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |} | ||

| + | |||

| + | NB. 2012 and 2013 Peripherals & Accessories figures include revenues for point cards | ||

| + | |||

| + | === Game Culture === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | |rowspan="2"|'''Year''' | ||

| + | |colspan="2"|'''Toys & Merchandise''' | ||

| + | |colspan="2"|'''Streaming & Game Video Content''' | ||

| + | |colspan="2"|'''Movies & Soundtracks''' | ||

| + | |colspan="2"|'''Books & Magazines''' | ||

| + | |colspan="2"|'''Events & Venues''' | ||

| + | |- | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

| + | |'''Spend''' | ||

| + | |'''% Growth''' | ||

|- | |- | ||

| − | | | + | |2020 |

| − | | | + | |£119.6m |

| − | | | + | | +22.4% |

| − | | | + | |£45.6m |

| − | | | + | | |

| + | |£22.9m | ||

| + | | -22.2% | ||

| + | |£10.5m | ||

| + | | -24.5% | ||

| + | |£249k | ||

| + | | -97.2% | ||

|- | |- | ||

| − | | | + | |2019 (revised) |

| − | | | + | |£97.7m |

| − | | | + | | |

| − | | | + | | |

| − | | | + | | |

| + | |£29.5.6m | ||

| + | | | ||

| + | |£13.9m | ||

| + | | | ||

| + | |£8.9m | ||

| + | | | ||

|- | |- | ||

| − | | | + | |2019 |

| − | | | + | |£94.2m |

| − | | | + | | +48.0% |

| − | | | + | | |

| − | | | + | | |

| + | |£29.5m | ||

| + | | +24.9% | ||

| + | |£13.9m | ||

| + | | -21.6% | ||

| + | |£8.8m | ||

| + | | -0.8% | ||

|- | |- | ||

| − | | | + | |2018 |

| + | |£59.3m | ||

| + | | -23.7% | ||

| + | | | ||

| | | | ||

| − | | | + | |£23.6m |

| − | | | + | | +34.0% |

| − | | | + | |£17.8m |

| + | | -1.3% | ||

| + | |£8.9m | ||

| + | | +5.5% | ||

|- | |- | ||

| − | | | + | |2017 |

| − | | | + | |£72.9m |

| − | |||

| − | |||

| +6.8% | | +6.8% | ||

| + | | | ||

| + | | | ||

| + | |£17.6m | ||

| + | | -29.9% | ||

| + | |£18.0m | ||

| + | | -2.3% | ||

| + | |£8.4m | ||

| + | | +13.4% | ||

|- | |- | ||

| − | | | + | |2016 |

| − | | | + | |£66.8m |

| − | | | + | | +7.2% |

| − | | | + | | |

| − | | | + | | |

| + | |£7.8m | ||

| + | | +14.4% | ||

| + | |£18.4m | ||

| + | | +13.2% | ||

| + | |£7.5m | ||

| + | | +20.6% | ||

|- | |- | ||

| − | | | + | |2015 |

| − | | | + | |£62.3m |

| − | | | + | | -9.7% |

| − | | | + | | |

| − | | -29. | + | | |

| + | |£6.9m | ||

| + | | +26.9% | ||

| + | |£16.3m | ||

| + | | -29.1% | ||

| + | |£6.2m | ||

| + | | +12.7% | ||

|- | |- | ||

| − | | | + | |2014 |

| − | | | + | |£69m |

| − | |7. | + | | +14.0% |

| − | | | + | | |

| − | | + | + | | |

| + | |£5.4m | ||

| + | | -21.7% | ||

| + | |£23m | ||

| + | | +77.0% | ||

| + | |£5.5m | ||

| + | | +96.4% | ||

|- | |- | ||

| − | | | + | |2013 |

| + | |£80m | ||

| + | | +3.8% | ||

| + | | | ||

| + | | | ||

| + | |£6.9m | ||

| + | | -4.0% | ||

| + | |£13m | ||

| | | | ||

| − | | | + | |£2.8m |

| − | | | + | | +16.0% |

| − | |||

|- | |- | ||

| − | | | + | |2012 |

| + | |£60m | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£7.5m | ||

| + | | | ||

| + | | | ||

| + | | | ||

| + | |£2.2m | ||

| | | | ||

| − | |||

| − | |||

| − | |||

|} | |} | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

Latest revision as of 09:00, 8 April 2021

Contents

About Ukie's UK Consumer Market Valuation

Every year, Ukie work with industry data partners to produce a valuation of UK consumer spend on games and game-related products.

Annual UK Consumer Market Valuations

- 2020 UK Consumer Games Market Valuation

- 2019 UK Consumer Games Market Valuation

- 2018 UK Consumer Games Market Valuation

- 2017 UK Consumer Games Market Valuation

- 2016 UK Consumer Games Market Valuation

- 2015 UK Consumer Games Market Valuation

- 2014 UK Consumer Games Market Valuation

- 2013 UK Consumer Games Market Valuation

- 2012 UK Consumer Games Market Valuation

Summary of Valuations to Date

Please note that each year, percentage growth is calculated from a revised estimation of the previous year to ensure consistency of measurement. Therefore growth amounts shown for each year may not directly correlate with the amounts shown in the official numbers for each year listed. Both reported and revised figures are provided for the most recent year in the tables below to demonstrate.

Annual Totals

| Year | Total Spend | % Growth |

| 2020 | £7.0bn | +29.9% |

| 2019 (revised) | £5.39bn | |

| 2019 | £5.35bn | -4.8% |

| 2018 | £5.7bn | +10.0% |

| 2017 | £5.11bn | +12.4% |

| 2016 | £4.33bn | +1.2% |

| 2015 | £4.19bn | +5.3% |

| 2014 | £3.94bn | +14.6% |

| 2013 | £3.48n | +19.9% |

| 2012 | £3.27bn |

Game Software

In 2020, the previous category of Digital & Online was split into the component parts of Digital Console and Digital PC. In the same year, new totals were also introduced for the combined digital and physical sales markets.

| Year | Digital & Online | Digital Console | Digital PC | Mobile Games | Combined Digital Sales | Boxed Games | Pre-Owned | Combined Physical Sales | ||||||||

| Spend | % Growth | Spend | % Growth | Spend | % Growth | Spend | % Growth | Spend | % Growth | Spend | % Growth | Spend | % Growth | Spend | % Growth | |

| 2020 | £1.7bn | +24.2 | £669m | +14.8 | £1.5bn | +21.3% | £3.9bn | +21.4% | £646m | +7.1% | £42.6m | -22.8% | £689m | +4.6% | ||

| 2019 (revised) | £1.4bn | £582m | £1.2bn | £3.2bn | £603m | £55.3m | £658m | |||||||||

| 2019 | £1.98bn | +0.6% | £1.21bn | +7.7% | £603m | -21.7% | £55.2m | -18.7% | ||||||||

| 2018 | £2.01bn | +20.3% | £1.17bn | +8.2% | £770.0m | -2.6% | £67.9m | -30.8% | ||||||||

| 2017 | £1.6bn | +13.4% | £1.07bn | +7.8% | £790.5m | +3.1% | £101.1m | -15.1% | ||||||||

| 2016 | £1.22bn | +11.1% | £955.1m | +16.9% | £766.7m | -15.2% | £119 | -3.3% | ||||||||

| 2015 | £1.224bn | +13.2% | £664m | +21.2% | £904m | -3.0% | £123m | +9.3% | ||||||||

| 2014 | £1.048bn | +17.6% | £548m | +21.2% | £935m | -6.3% | £106.8m | +10.7% | ||||||||

| 2013 | £819m | +25.0% | £430m | +83.0% | £998m | -5.0% | £78m | |||||||||

| 2012 | £520 | £158m | £1.42bn | |||||||||||||

Game Hardware

| Year | Console Hardware | PC Game Hardware | Peripherals & Accessories | VR Hardware | ||||

| Spend | % Growth | Spend | % Growth | Spend | % Growth | Spend | % Growth | |

| 2020 | £853m | +74.8% | £823m | +69.7% | £453m | +36.9% | £129m | +29.0% |

| 2019 (revised) | £488m | £485m | £331m | £100m | ||||

| 2019 | £488m | -30.5% | £469m | +6.1% | £331m | -6.8% | £65.8m | -12.0% |

| 2018 | £702.0m | +6.5% | £445.0m | +18.4% | £355.0m | +19.9% | £72.0m | -20.9% |

| 2017 | £659.3m | +29.9% | £376m | +51.0% | £296.1m | -1.4% | £100.8m | +23.5% |

| 2016 | £507.5m | -26.7% | £258m | +64.3% | £300.1m | -16.6% | £61.3m | |

| 2015 | £689m | -24.7% | £138m | £360m | +24.6% | |||

| 2014 | £915m | +42.6% | £288m | +4.3% | ||||

| 2013 | £626m | +38.0% | £424m | +1.0% | ||||

| 2012 | £453m | £646m | ||||||

NB. 2012 and 2013 Peripherals & Accessories figures include revenues for point cards

Game Culture

| Year | Toys & Merchandise | Streaming & Game Video Content | Movies & Soundtracks | Books & Magazines | Events & Venues | |||||

| Spend | % Growth | Spend | % Growth | Spend | % Growth | Spend | % Growth | Spend | % Growth | |

| 2020 | £119.6m | +22.4% | £45.6m | £22.9m | -22.2% | £10.5m | -24.5% | £249k | -97.2% | |

| 2019 (revised) | £97.7m | £29.5.6m | £13.9m | £8.9m | ||||||

| 2019 | £94.2m | +48.0% | £29.5m | +24.9% | £13.9m | -21.6% | £8.8m | -0.8% | ||

| 2018 | £59.3m | -23.7% | £23.6m | +34.0% | £17.8m | -1.3% | £8.9m | +5.5% | ||

| 2017 | £72.9m | +6.8% | £17.6m | -29.9% | £18.0m | -2.3% | £8.4m | +13.4% | ||

| 2016 | £66.8m | +7.2% | £7.8m | +14.4% | £18.4m | +13.2% | £7.5m | +20.6% | ||

| 2015 | £62.3m | -9.7% | £6.9m | +26.9% | £16.3m | -29.1% | £6.2m | +12.7% | ||

| 2014 | £69m | +14.0% | £5.4m | -21.7% | £23m | +77.0% | £5.5m | +96.4% | ||

| 2013 | £80m | +3.8% | £6.9m | -4.0% | £13m | £2.8m | +16.0% | |||

| 2012 | £60m | £7.5m | £2.2m | |||||||