Difference between revisions of "Esports"

m |

m (→Audience) |

||

| (2 intermediate revisions by the same user not shown) | |||

| Line 17: | Line 17: | ||

== Largest Prize Pools == | == Largest Prize Pools == | ||

| − | The [https://dotesports.com/general/news/biggest-prize-pools-esports-14605 largest prize pools at unique international esports tournament series] as of August 2021 | + | The [https://dotesports.com/general/news/biggest-prize-pools-esports-14605 largest prize pools at unique international esports tournament series] as of August 2021 are as follows. Note that only the highest ever prize pool of a given tournament series appears here. The 10 highest prize pools of all time are reproduced below. |

{| class="wikitable" | {| class="wikitable" | ||

| Line 88: | Line 88: | ||

|} | |} | ||

| − | The following table shows the largest prize pools for any single event in esports history. [https://dotesports.com/general/news/biggest-prize-pools-esports-14605 Dot Esports] | + | The following table shows the largest prize pools for any single event in esports history. ([https://dotesports.com/general/news/biggest-prize-pools-esports-14605 Dot Esports]) |

{| class="wikitable" | {| class="wikitable" | ||

| Line 163: | Line 163: | ||

=== Market === | === Market === | ||

| − | *Global esports revenues are expected to reach $1.084bn in 2021, up 14.5% from 2020. | + | *Global esports revenues are expected to reach $1.084bn in 2021, up 14.5% from 2020. ([https://newzoo.com/insights/articles/viewership-engagement-continues-to-skyrocket-across-games-and-esports-the-global-live-streaming-audience-will-pass-700-million-this-year/ Newzoo], Mar 2021) |

**This figure comprises | **This figure comprises | ||

***Sponsorships: $641.0m (59%) | ***Sponsorships: $641.0m (59%) | ||

| Line 175: | Line 175: | ||

=== Audience === | === Audience === | ||

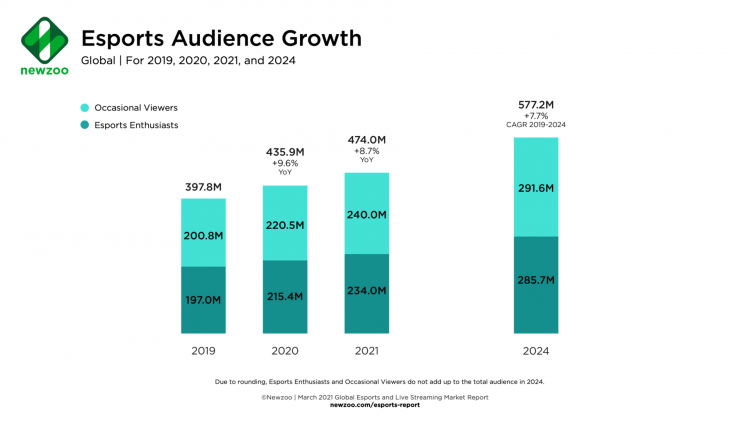

| − | *The global esports audience is expected to grow to 474.0m people in 2021, up 8.7% on 2020, while the expected broader live-streaming audience is expected to reach 728.8m. The pandemic accelerated growth in livestreaming audiences. | + | *The global esports audience is expected to grow to 474.0m people in 2021, up 8.7% on 2020, while the expected broader live-streaming audience is expected to reach 728.8m. The pandemic accelerated growth in livestreaming audiences. ([https://newzoo.com/insights/articles/viewership-engagement-continues-to-skyrocket-across-games-and-esports-the-global-live-streaming-audience-will-pass-700-million-this-year/ Newzoo], Mar 2021) |

**240.0m (51%) people are occasional viewers, with a further 234.0m (49%) esports enthusiasts, defined as those watching professional esports content at least once a month. | **240.0m (51%) people are occasional viewers, with a further 234.0m (49%) esports enthusiasts, defined as those watching professional esports content at least once a month. | ||

**China is expected to be home to the most esports enthusiasts in 2021 with 92.8m viewers, ahead of the USA and Brazil. | **China is expected to be home to the most esports enthusiasts in 2021 with 92.8m viewers, ahead of the USA and Brazil. | ||

**The global average revenue per esports enthusiast is estimated to be $4.63 in 2021, up 2.8% from 2020's $4.40, but down 4.7% from 2019's $4.86 potentially owing to the lack of live events during the pandemic. This figure is expected to rise to $5.25 in 2022 with the restoration of the calendar of live events. | **The global average revenue per esports enthusiast is estimated to be $4.63 in 2021, up 2.8% from 2020's $4.40, but down 4.7% from 2019's $4.86 potentially owing to the lack of live events during the pandemic. This figure is expected to rise to $5.25 in 2022 with the restoration of the calendar of live events. | ||

| − | |||

== 2020 Stats == | == 2020 Stats == | ||

Latest revision as of 16:23, 1 September 2021

Contents

Background

Origins

In 1980 an Atari Space Invaders tournament with around 10,000 entrants attempting to record the high score, spawned the idea of competitive gaming on a scale similar to sports events.

The release of multiplayer console games such as Street Fighter II, Doom, Quake and Starcraft in the 1990s drove further interest in competitive gaming and the creation of more games tournaments.

With the introduction of online services such as Xbox Live in the early 2000s, console owners were able to play cooperatively or against each other online in popular titles including Halo and Call of Duty.

Growth in Popularity

Advances in broadband internet and the rise of video content and new online services and the founding of organisations such as ESL through the 2000s and 2010s generated further interest in esports. During this period, MOBA games (Multiplayer Online Battle Arena) League of Legends and Dota 2 became some of the most popular competitive games. First-person-shooters such as Overwatch and Rainbow Six Siege, sports games such as FIFA and battle royale games such as Fortnite also have major esports tournaments offering millions of dollars in prize money.

Largest Prize Pools

The largest prize pools at unique international esports tournament series as of August 2021 are as follows. Note that only the highest ever prize pool of a given tournament series appears here. The 10 highest prize pools of all time are reproduced below.

| Rank | Year | Game | Tournament Series | Prize Pool |

|---|---|---|---|---|

| 1 | 2019 | Dota 2 | The International 9 | $34.3m |

| 2 | 2019 | Fortnite | Fortnite World Cup Finals | $30.4m |

| 3 | 2021 | Player Unknown's Battlegrounds | PUBG Global Invitational.S | $7.1m |

| 4 | 2018 | League of Legends | League of Legends World Championship | $6.4m |

| 5 | 2020 | Honor of Kings | Honor of Kings World Champion Cup | $4.6m |

| 6 | 2020 | Call of Duty: Modern Warfare (2019) | Call of Duty League Championship | $4.6m |

| 7 | 2018 | Fortnite | Fortnite Fall Skirmish Series - Clubs Standings | $4m |

| 8 | 2019 | Player Unknown's Battlegrounds | PUBG Global Championship | $4m |

| 9 | 2019 | Overwatch | Overwatch League - Playoffs | $3.5m |

| 10 | 2015 | Dota 2 | Dota 2 Asia Championship | $3m |

The following table shows the largest prize pools for any single event in esports history. (Dot Esports)

| Rank | Year | Game | Tournament | Prize Pool |

|---|---|---|---|---|

| 1 | 2019 | Dota 2 | The International 9 | $34.3m |

| 2 | 2019 | Fortnite | Fortnite World Cup Finals | $30.4m |

| 3 | 2018 | Dota 2 | The International 8 | $25.5m |

| 4 | 2017 | Dota 2 | The International 7 | $24.7m |

| 5 | 2016 | Dota 2 | The International 6 | $20.7m |

| 6 | 2015 | Dota 2 | The International 5 | $18.4m |

| 7 | 2014 | Dota 2 | The International 4 | $10.9m |

| 8 | 2021 | Player Unknown's Battlegrounds | PUBG Global Invitational.S | $7.1m |

| 9 | 2018 | League of Legends | League of Legends World Championship | $6.4m |

| 10 | 2017 | League of Legends | League of Legends World Championship | $4.9m |

2021 Stats

Market

- Global esports revenues are expected to reach $1.084bn in 2021, up 14.5% from 2020. (Newzoo, Mar 2021)

- This figure comprises

- Sponsorships: $641.0m (59%)

- Media Rights: $192.6m (18%)

- Publisher Fees: $126.6m (12%)

- Merchandise & Tickets: $66.6m (13.8%)

- Digital: $32.3m (3%)

- Streaming: $25.1m (2%)

- Western Europs is the 3rd largest region for esports revenues at $205.8m, behind North America with $243.0m and China with $360.1m.

- This figure comprises

Audience

- The global esports audience is expected to grow to 474.0m people in 2021, up 8.7% on 2020, while the expected broader live-streaming audience is expected to reach 728.8m. The pandemic accelerated growth in livestreaming audiences. (Newzoo, Mar 2021)

- 240.0m (51%) people are occasional viewers, with a further 234.0m (49%) esports enthusiasts, defined as those watching professional esports content at least once a month.

- China is expected to be home to the most esports enthusiasts in 2021 with 92.8m viewers, ahead of the USA and Brazil.

- The global average revenue per esports enthusiast is estimated to be $4.63 in 2021, up 2.8% from 2020's $4.40, but down 4.7% from 2019's $4.86 potentially owing to the lack of live events during the pandemic. This figure is expected to rise to $5.25 in 2022 with the restoration of the calendar of live events.

2020 Stats

- The global esports market will generate revenues of $1,059.3m in 2020, a small revision on the previous estimate of $1,100.1 due to coronoavirus impacts, according to data from Newzoo. (Newzoo, Apr 2020)

- This downward revision is not related decreased demand (the audience is not smaller) or decreased supply (the number of events organizers want to put on is not fewer). Rather, due to the ongoing COVID-19 outbreak, many events have been postponed, canceled, or moved to online formats.

- Within this analysis, esports merchandise revenues in 2020 were revised to $106.5m (from $121.7m), media rights to $176.2 (from $185.4m) and sponsorships to $614.9m (from $636.9m). However, team streaming revenues were revised upwards to $19.9m (from $18.2m) and global publisher fees to $120.2 million.

- By 2023, global esports revenues are expected to reach $1,598.2m, an upwards revision from previous estimates of $1,556.7m. (Newzoo, Apr 2020)

2019 Stats

- In 2019, it is expected that the global esports market will surpass the billion-dollar mark for revenue for the first time - growing +26.7% year-on-year to reach $1.1billion. (Newzoo, Feb 2019)

- North America will generate $409.1 million of this amount, while China will account for $210.3 million, overtaking Western Europe as the second-largest region in terms of revenues.

- By 2022, it is estimated global esports revenues will reach $1.79bn, a CAGR of 22.3% from 2017.

- In 2019, $897.2 million in revenues, or 82% of the total market, will come from brand investments (media rights, advertising, and sponsorship). This will increase to $1.5 billion by 2022, making up 87% of total esports revenues. (Newzoo, Feb 2019)

- In 2019, esports revenues breakdown as follows:

- Sponsorship - $456.7m (+34.3% yoy)

- Media Rights - $251.3m (+41.8% yoy)

- Advertising - $189.2m (+14.8% yoy)

- Merchandise & Tickets - $103.7m (+22.4% yoy)

- Game Publisher Fees - $95.2m (+3.0% yoy)

- In 2019, esports revenues breakdown as follows:

- The global esports audience will grow to 453.8 million worldwide in 2019, a year-on-year growth of +15%. This will comprise of 201.2 million 'esports enthusiasts' (who view more than once a month), and 252.6 million 'occasional viewers (those who view less than once a month). (Newzoo, Feb 2019)

- China will have the most 'esports enthusiasts' in 2019 with 75.0 million, followed by the U.S. and Brazil. South Korea will have the highest share of 'esports enthusiasts' relative to its online population in 2019 with 12%.

- By 2022, the global esports audience is predicted to reach 645 million people, with 297 million 'esports enthusiasts'.

- The global average revenue per 'esports enthusiast' will be $5.45 this year, up +8.9% from $5.00 in 2018. (Newzoo, Feb 2019)

- In 2018, there were 737 major events. Together, they generated for $54.7 million in ticket revenues, down from $58.9 million in 2017. (Newzoo, Feb 2019)

- The total prize money in 2018 reached $150.8 million, a significant increase from 2017’s $112.1 million. (Newzoo, Feb 2019)

- The League of Legends World Championship was 2018’s biggest tournament by live viewership hours on Twitch, with 53.8 million hours. It also produced $1.9 million in ticket revenues. The Overwatch League was the most-watched league by live viewership hours on Twitch, generating 79.5 million hours. (Newzoo, Feb 2019)

- 335 million people watch esports in Europe, an increase of 36% since 2016, with revenues anticipated to reach $346m in 2018. (ISFE, May 2019)

- In 2018/19, 6.2% of UK adults reported having watched a professionally organised computer or video game tournament in the last year and 1.1% had played in a professionally organised computer or video game tournament in that period. (DCMS Taking Part Survey, Dec 2019)

2018 Stats

- The global esports market is set to grow 20.6% year-on-year, from $620m in 2017 to US$1.6bn by 2022. (PwC, Jun 2018)

- The UK’s second fastest growing entertainment and media sector is esports, growing 21% year on year to reach £48m in revenue by 2022. (PwC / City AM / digitsaltveurope.com, Jun 2018)

- Esports generated $756m in revenue and attracted 258M unique viewers in 2017, with the sector set to worth £1,138bn in 2018. (Superdata, Jan 2018)

- According to Superdata, the $756m esport market in 2017 was split 70% sponsorship and ads, 11% prize pools, 10% amateur tournaments and 9% merchandise and ticket sales. (Superdata, Jan 2018)

- The most popular esport games by viewership in 2017 were League of Legends (157m), PlayerUknknown’s Battlegrounds(102m) and Hearthstone (83m). (Superdata, Jan 2018)

- The largest prize pool event held in the UK to date was ESL One Birmingham, with a prize pool of $1 million, held at Arena Birmingham in May 2018. (ESL, May 2018)

2017 Stats

- 191m people will watch esports at least once a month in 2017, with a further 194m watching less regularly (total: 385m). (Newzoo, May 2017)

- In 2017, Europe will reach an esports audience size of 77m people and will account for 32% of global esports economy revenues. (Newzoo, Dec 2017)

- The largest esports event in Europe in 2017 was ESL’s ‘Intel Extreme Masters Season XI’, in Katowice, Poland with an attendance of 173,000. The largest event by hours of streamed via Twitch was PGL’s 2017 Kiev Major, with 23.3m hours watched. (Newzoo, Dec 2017)

- By September 2017, there have been 90 disclosed eSports funding deals globally worth $1.2B, already ahead of full-year figures in 2015 (which saw 84 deals totaling $942M). At the current run rate, deals are projected to hit a new record of 136 deals totaling $1.9B — representing a 64% uptick in deals and a 23% increase in funding from 2016. (CBInsights, Sept 2017)

- At a quarterly level, Q2’17 saw 35 deals, beating the previous quarterly record of 31 deals in Q3’16 and Q1’17. Q3’16 holds the quarterly record for funding, with $934M invested — meaning the quarter singlehandedly accounted for 62% of the full year’s funding. (CBInsights, Sept 2017)

- Esports content reaches consumers that don’t necessarily play the games. 23% of the fanbase of the top 3 esports franchises in North American and Western Europe don’t play the game they watch. (Newzoo, May 2017)

- The UK esports market will see a 27.6% CAGR, reaching £8m in consumer ticket sales by 2021. Digital advertising in esports will increase by 46.2% CAGR to £12m by 2021. (PWC, June 2017)

2016 Stats

- The global esports market was worth $0.9bn in 2016 and will grow to $1.4bn by 2019. (SuperData, Dec 2016)

- US male millennials are just as likely to watch esports (22%) as baseball or hockey. (Newzoo, Oct 2016)

- US Esports Enthusiasts will watch esports in preference of traditional sports, with 76% stating that esports viewing is taking away hours they used to spend watching sports. (Newzoo, Oct 2016)

- Total global esport revenue will reach $892.8m in 2016, up to $1.1bn in 2018. (Superdata, May 2016)

- Although Asia still leads at $328m (37%), North America and Europe are up to $275 (31%) and $269m (30%) respectively. (Superdata, May 2016)

- The largest prize pool held in the UK to date was the $765,000 ECS Season One final, held at Wembley SSE Arena in June 2016 and organised by UK-based FaceIT and Twitch. (ECS, May 2016)

- The UK esports audience will reach 6.5 million in 2016, with 3.1 million people watching more than once a month. (Newzoo, Aug 2016)

- The UK esports audience skews 69% male, 31% female. The 21-35 age group represents 63% of the market. Women most likely to watch esports when aged between 21-35 (making up 21% of the overall market, compared to the 42% share for men of the same age). (Newzoo, Aug 2016)

- UK esports fans are far more likely to participate in physical team sports (65%) than the general online population (21%) and are more likely to subscribe to Spotify (48% vs 14%). (Newzoo, Aug 2016)

- 35% (18.3m) of UK adults are aware of eSports, split as 48% of males and 23% of females aware. Esports has greater awareness among younger demogrpahics, with 64% of 18-24y/o and 59% of 25-34y/o aware. (eSports report - Just a game.pdf YouGov, Sept 2017)

- Of the 7% (3.6m) of the UK population has watched esports, the gender split is more evenly split at 55% male and 45% female. 22% of viewers watch more than once a month and 7% more than once a week. (eSports report - Just a game.pdf YouGov, Sept 2017)

- UK football clubs including Manchester City and West Ham have signed professional esports players. (BBC #1 and #2)

- Viewership for esports has grown to 188m in 2015, with more than a third of American esports fans choosing tournaments to watch based on their favorite teams and players. (Superdata, Jan 2016)

- The $748m of global revenues were broken down into 77% ($578.6m) from indirect sources like sponsorship and advertising and 23% ($168.9m) from direct sources, such as esports betting and fantasy sites (7%, $55.8m), prize pools (7%, $53.8m), amateur and micro tournaments (4%, $27.7m), merchandise (2%, $17m) and ticket sales (2%, $15.9m). (Superdata, Jan 2016)

- 2015 also saw the expansion of esports into the mobile platform. For instance Hearthstone’s revenues and monthly active users have really grown since its launch on smartphones in April 2015: the monthly active users grew by +140% then. Another example is the mobile-only MOBA Vainglory, which was specifically created to be an esport. (Superdata, Jan 2016)

- According to Newzoo’s quarterly Global esports Market Awareness report, eSports awareness will reach 1bn consumers in 2016, up 36% compared to 2015. From the 16 countries studied, the average awareness of esports among gamers increased from 53.7% in 2015 to 65.7% in 2016. (Newzoo, May 2016)

- The global esports audience will grow to 292 million people in 2016, 148m of which are “enthusiasts”, playing or viewing more than once a month. In 2015, esports “enthusiasts” were split 69% male and 54% aged 21-35yo. (Newzoo, May 2016)

- Esports revenues (from media rights, merchandise & tickets, online advertising, brand partnerships and additional game publisher investment) are set to grow to $463m in 2016, a 43% increase from 2015, and eclipse $1bn by 2019, a 40.7% CAGR from 2014’s $194m. (Newzoo, Mar 2016)

- Esports fans are an attractive audience for marketers, with an average income of $69k and over half comprised of Millennials (51%). (Nielsen, Apr 2016)

- 21.3% of all hours watched on Twitch from July to December 2015 was esports content, totalling 475.5 million hours of esports watched across all esports franchises. MOBAs account for 58% of the esports viewing and a further 27% for shooters. (Newzoo, Apr 2016)

2015 Stats

- The prize pools for 2015 should be worth $42m, and it appears that the growing prize pools attract more viewers. (Superdata, May 2015)

- Looking at esports audience gender: 87% is male, 13% female (could be linked to the fact only 2 of the Top 200 esports players are female). (Superdata, May 2015)

- The average size of a transaction on esports merchandise (apparel, headphones, mice and mousepads) is $42.30 in key western markets. (Superdata, May 2015)

- US viewers buy 3 full games per month, and have an average $200 monthly budget for games (44% spent on full game, 24% on in-game purchases and 32% on peripheral devices). (Superdata, May 2015)