Difference between revisions of "Regional Economic Impacts of the UK Games Industry"

(Created page with "== Scotland == {| class="wikitable" !Location !Games Companies !Full-Time Employees !Direct GVA (£) !Total GVA (£) |- |Dundee |33 |306 |17.6 |30.9 |- |Edinburgh |32 |657 |4...") |

|||

| (24 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | + | [[File:Think-Global-Create-Local-cover.png|thumb|500px|[https://ukie.org.uk/regional-economic-report '''Think Global, Create Local'''] - The regional economic impact of the UK games industry, released by Ukie in February 2020]] | |

| + | == Think Global, Create Local == | ||

| + | |||

| + | === Summary === | ||

| + | |||

| + | '''Think Global, Create Local''' is an analysis of the employment and economic impact of the UK games industry across the towns, cities, regions and devolved nations of the UK, released by Ukie in February 2020. It provides new benchmark figures for the number of full-time equivalent jobs (FTEs) and contribution to gross value added (GVA) generated by games companies throughout the country, the impacts of companies of different sizes and comparisons against other sectors. | ||

| + | |||

| + | The full report can be downloaded here: [https://ukie.org.uk/regional-economic-report '''Think Global, Create Local'''] | ||

| + | |||

| + | === About this report === | ||

| + | |||

| + | The report builds on the findings from the BFI's 'Screen Business' report, released in Ocotber 2018, which showed that the UK games companies directly employed '''16,140 FTE roles''' and collectively generated '''£2.87bn in GVA'''. | ||

| + | |||

| + | By applying HM Treasury 'Green Book' principles and best practice economic modelling, 'Screen Business' is the single most authoritative economic analysis of the UK games sector to date. Think Global, Create Local uses the same methodologies to futher explore the same underlying data, ensuring robust results at the highest possible standards. As this means no underlying data could therefore be updated, all results in this report relate to the year 2016 and represent a snapshot in time for our sector. It should also be understood that since 2016, the UK games industry has continued to thrive, and that this report reflects that benchmark from which future growth can be reliably tracked. | ||

| + | |||

| + | === Key Findings === | ||

| + | |||

| + | *'''Eight games hubs''' contributed over '''£60m in GVA''' to their local economies: Edinburgh, Newcastle Upon Tyne, Leamington Spa, Crawley and Horsham, Manchester, Guildford, Slough and Heathrow, and London. | ||

| + | |||

| + | *'''55%''' of game development roles are based '''outside of London and the South East'''. | ||

| + | |||

| + | *The North West, East of England, West Midlands, Scotland and the South East all employ '''over 1,000 FTEs in development studio roles'''. | ||

| + | |||

| + | *'''London's''' game sector is a billion pound industry, generating '''£1.4bn in GVA''' for the economy and directly employing '''over 5,100 FTE roles'''. | ||

| + | |||

| + | *'''23 towns and cities''' across the UK are home to '''more than 20 local game companies'''. | ||

| + | |||

| + | *'''Scotland''' is home to a thriving games industry, with three major hubs generating '''£131m in GVA''' for the nation. | ||

| + | |||

| + | *The '''North East''' games industry has the '''biggest impact''' on the local economy outside of London, contributing '''£1.90 of every £1,000 of regional GVA'''. | ||

| + | |||

| + | *'''99.5%''' of UK games companies are officially '''SMEs''' (Small to Medium Enterprises, employing less than 250 people), which collectively contribute '''£1.6bn in GVA'''. | ||

| + | |||

| + | *'''£339m''' in GVA is generated by '''micro-businesses''' of less than 10 employees, representing 13.7% of the industry total, and employing '''3,664 FTEs'''. | ||

| + | |||

| + | *The '''very largest games companies''', each employing over 250 people, are '''hugely important''' to the UK economy, alone contributing '''£840m in GVA''' and employing '''over 4,200 FTEs''', or 26% of the industry workforce. | ||

| + | |||

| + | === Gross Value Added === | ||

| + | |||

| + | Gross value added (GVA) is the measure of the economic value of goods and services. This can be used to compare the economic impact of different sectors or compare the impact of the same sector in different geographic areas. All measures of GVA in this article relate to data originally from the BFI's [https://www.bfi.org.uk/sites/bfi.org.uk/files/downloads/screen-business-full-report-2018-10-08.pdf Screen Business Report (October 2018)]. The [https://www.bfi.org.uk/sites/bfi.org.uk/files/downloads/screen-business-appendices-4-and-5-2018-10-08.pdf methodology of this report] explains how direct and total GVA figures are calculated. | ||

| + | |||

| + | === Regions with the Highest GVA from Games Companies === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !Region | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£M) | ||

| + | !Total GVA (£M) | ||

| + | |- | ||

| + | |London | ||

| + | |588 | ||

| + | |5107 | ||

| + | |729.2 | ||

| + | |1390.2 | ||

| + | |- | ||

| + | |South East | ||

| + | |376 | ||

| + | |3266 | ||

| + | |197.3 | ||

| + | |356.3 | ||

| + | |- | ||

| + | |North West | ||

| + | |174 | ||

| + | |1315 | ||

| + | |89.9 | ||

| + | |157.3 | ||

| + | |- | ||

| + | |Scotland | ||

| + | |113 | ||

| + | |1156 | ||

| + | |75.0 | ||

| + | |131.2 | ||

| + | |- | ||

| + | |West Midlands | ||

| + | |134 | ||

| + | |1209 | ||

| + | |74.6 | ||

| + | |130.8 | ||

| + | |- | ||

| + | |North East | ||

| + | |52 | ||

| + | |518 | ||

| + | |56.7 | ||

| + | |99.9 | ||

| + | |- | ||

| + | |East Midlands | ||

| + | |95 | ||

| + | |906 | ||

| + | |42.3 | ||

| + | |74.1 | ||

| + | |- | ||

| + | |East of England | ||

| + | |166 | ||

| + | |1209 | ||

| + | |30.9 | ||

| + | |54.3 | ||

| + | |- | ||

| + | |Yorkshire and the Humber | ||

| + | |149 | ||

| + | |767 | ||

| + | |24.5 | ||

| + | |42.9 | ||

| + | |- | ||

| + | |South West | ||

| + | |152 | ||

| + | |423 | ||

| + | |18.5 | ||

| + | |32.5 | ||

| + | |- | ||

| + | |Wales | ||

| + | |54 | ||

| + | |172 | ||

| + | |8.2 | ||

| + | |14.4 | ||

| + | |- | ||

| + | |Northern Ireland | ||

| + | |35 | ||

| + | |77 | ||

| + | |3.2 | ||

| + | |5.6 | ||

| + | |- | ||

| + | |||

| + | |} | ||

| + | |||

| + | === Travel to Work Areas with the Highest GVA from Games Companies === | ||

| + | A travel to work area (TTWA) is a UK Government statistical tool used to indicate an area where a significant proportion of the population commute to a larger town or city for work. TTWAs where games companies provide high levels of economic value can be found throughout the UK, as shown in the below table: | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !TTWA | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£M) | ||

| + | !Total GVA (£M) | ||

| + | |- | ||

| + | |London | ||

| + | |573 | ||

| + | |4980 | ||

| + | |715.4 | ||

| + | |1362 | ||

| + | |- | ||

| + | |Slough and Heathrow | ||

| + | |62 | ||

| + | |595 | ||

| + | |58.8 | ||

| + | |116.2 | ||

| + | |- | ||

| + | |Leamington Spa | ||

| + | |34 | ||

| + | |907 | ||

| + | |57.4 | ||

| + | |100.7 | ||

| + | |- | ||

| + | |Newcastle upon Tyne | ||

| + | |20 | ||

| + | |372 | ||

| + | |48.6 | ||

| + | |85.8 | ||

| + | |- | ||

| + | |Crawley (incl. Horsham) | ||

| + | |24 | ||

| + | |579 | ||

| + | |47.8 | ||

| + | |83.7 | ||

| + | |- | ||

| + | |Edinburgh | ||

| + | |32 | ||

| + | |657 | ||

| + | |45.9 | ||

| + | |80.3 | ||

| + | |- | ||

| + | |Manchester | ||

| + | |82 | ||

| + | |369 | ||

| + | |37.7 | ||

| + | |66.1 | ||

| + | |- | ||

| + | |Guildford and Aldershot | ||

| + | |64 | ||

| + | |855 | ||

| + | |36.6 | ||

| + | |64.0 | ||

| + | |- | ||

| + | |Liverpool | ||

| + | |35 | ||

| + | |152 | ||

| + | |21.7 | ||

| + | |38.0 | ||

| + | |- | ||

| + | |Dundee | ||

| + | |33 | ||

| + | |306 | ||

| + | |17.6 | ||

| + | |30.9 | ||

| + | |- | ||

| + | |Cambridge | ||

| + | |47 | ||

| + | |853 | ||

| + | |16.4 | ||

| + | |28.7 | ||

| + | |- | ||

| + | |Crewe (incl. Knutsford) | ||

| + | |8 | ||

| + | |558 | ||

| + | |16.4 | ||

| + | |28.6 | ||

| + | |- | ||

| + | |Lincoln | ||

| + | |8 | ||

| + | |328 | ||

| + | |15.3 | ||

| + | |26.7 | ||

| + | |- | ||

| + | |Brighton | ||

| + | |65 | ||

| + | |277 | ||

| + | |13.7 | ||

| + | |24.1 | ||

| + | |- | ||

| + | |Medway | ||

| + | |4 | ||

| + | |146 | ||

| + | |12.3 | ||

| + | |21.6 | ||

| + | |- | ||

| + | |Nottingham | ||

| + | |31 | ||

| + | |194 | ||

| + | |10.6 | ||

| + | |18.5 | ||

| + | |- | ||

| + | |Milton Keynes | ||

| + | |17 | ||

| + | |95 | ||

| + | |9.5 | ||

| + | |17.7 | ||

| + | |- | ||

| + | |Sheffield | ||

| + | |43 | ||

| + | |331 | ||

| + | |9.9 | ||

| + | |17.3 | ||

| + | |- | ||

| + | |Burton upon Trent (incl. Twycross) | ||

| + | |8 | ||

| + | |113 | ||

| + | |9.7 | ||

| + | |17.0 | ||

| + | |- | ||

| + | |Oxford | ||

| + | |26 | ||

| + | |312 | ||

| + | |8.0 | ||

| + | |14.4 | ||

| + | |} | ||

| + | |||

| + | === Scotland === | ||

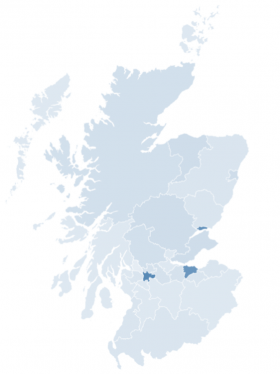

| + | [[File:Scotland map.png|thumb|280px|Heap map of games companies in Scotland - highlights Dundee, Glasgow and Edinburgh as the game hubs in the nation.]] | ||

{| class="wikitable" | {| class="wikitable" | ||

!Location | !Location | ||

!Games Companies | !Games Companies | ||

!Full-Time Employees | !Full-Time Employees | ||

| − | !Direct GVA ( | + | !Direct GVA (£m) |

| − | !Total GVA ( | + | !Total GVA (£m) |

|- | |- | ||

|Dundee | |Dundee | ||

| Line 34: | Line 291: | ||

|} | |} | ||

| − | + | Game Development Meetups & Groups: | |

| + | *[https://twitter.com/GameDevEd Game Dev Ed] (Edinburgh) | ||

| + | *[https://igdascotland.org/ IGDA Scotland] (Scotland) | ||

| + | *[https://scottishgames.net/ Scottish Games] (Scotland) | ||

| + | *[https://www.innovationforgames.com/ InGAME] (Dundee) | ||

| + | |||

| + | Key Facts: | ||

| + | *Around three quarters of Scottish games companies are based in Edinburgh, Dundee or Glasgow. | ||

| + | *There are however, small games companies throughout the rest of Scotland | ||

| + | === Wales === | ||

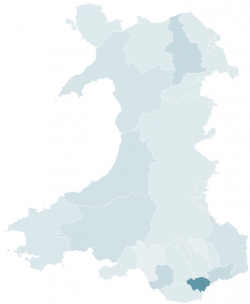

| + | [[File:Wales map.png|thumb|250px|Heap map of games companies in Wales, where Cardiff is a significant hub for games development.]] | ||

{| class="wikitable" | {| class="wikitable" | ||

!Location | !Location | ||

!Games Companies | !Games Companies | ||

!Full-Time Employees | !Full-Time Employees | ||

| − | !Direct GVA ( | + | !Direct GVA (£m) |

| − | !Total GVA ( | + | !Total GVA (£m) |

|- | |- | ||

|Bridgend | |Bridgend | ||

| Line 64: | Line 331: | ||

|} | |} | ||

| − | == Northern Ireland == | + | Game Development Meetups & Groups: |

| + | *[http://gameswales.org/ Games Wales] | ||

| + | |||

| + | Key Facts: | ||

| + | *Around half of games companies in Wales are based in Cardiff, with the remaining other half operating throughout the rest of the country. | ||

| + | *Games companies provide a higher proportion of overall GVA in Bridgend than in any other Welsh town or city. | ||

| + | |||

| + | === Northern Ireland === | ||

| + | [[File:NI map.png|thumb|250px|Heap map of games companies in Northern Ireland, where most developers operate in or around Belfast.]] | ||

| + | {| class="wikitable" | ||

| + | !Location | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£m) | ||

| + | !Total GVA (£m) | ||

| + | |- | ||

| + | |Belfast | ||

| + | |21 | ||

| + | |48 | ||

| + | |2.0 | ||

| + | |3.5 | ||

| + | |- | ||

| + | !Northern Ireland | ||

| + | |35 | ||

| + | |77 | ||

| + | |3.2 | ||

| + | |5.6 | ||

| + | |||

| + | |} | ||

| + | |||

| + | Game Development Meetups & Groups: | ||

| + | *[http://www.gamesni.com/ Games NI] | ||

| + | |||

| + | Key Facts: | ||

| + | *5 of Northern Ireland’s 6 counties have games companies operating in them. | ||

| + | *The majority of games companies in Northern Ireland are in Belfast | ||

| + | |||

| + | === North West === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !Location | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£m) | ||

| + | !Total GVA (£m) | ||

| + | |- | ||

| + | |Crewe | ||

| + | |8 | ||

| + | |558 | ||

| + | |16.4 | ||

| + | |28.6 | ||

| + | |- | ||

| + | |Liverpool | ||

| + | |35 | ||

| + | |152 | ||

| + | |21.7 | ||

| + | |38.0 | ||

| + | |- | ||

| + | |Manchester | ||

| + | |82 | ||

| + | |369 | ||

| + | |37.7 | ||

| + | |66.1 | ||

| + | |- | ||

| + | !North West | ||

| + | |174 | ||

| + | |1315 | ||

| + | |89.9 | ||

| + | |157.3 | ||

| + | |||

| + | |} | ||

| + | |||

| + | Game Development Meetups & Groups: | ||

| + | *[https://www.facebook.com/events/606802006423370/ Gamedev Liverpool] (Liverpool) | ||

| + | *[http://gameopolis.org.uk/ Gameopolis] (Greater Manchester) | ||

| + | *[https://twitter.com/gameclusterLPL Liverpool Games Cluster] (Liverpool) | ||

| + | *[https://www.meetup.com/WA-Games/ WA Games] (Warrington) | ||

| + | |||

| + | Key Facts: | ||

| + | *Crewe, Liverpool and Manchester are hubs for games development. | ||

| + | *With around 1,300 games industry jobs in the north west, the region comes 3rd for number of games jobs | ||

| + | *The region also comes 3rd for total GVA from the industry | ||

| + | |||

| + | === North East=== | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !Location | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£m) | ||

| + | !Total GVA (£m) | ||

| + | |- | ||

| + | |Newcastle upon Tyne | ||

| + | |20 | ||

| + | |372 | ||

| + | |48.6 | ||

| + | |85.8 | ||

| + | |- | ||

| + | |Sunderland | ||

| + | |12 | ||

| + | |84 | ||

| + | |3.0 | ||

| + | |5.3 | ||

| + | |- | ||

| + | !North East | ||

| + | |52 | ||

| + | |518 | ||

| + | |56.7 | ||

| + | |99.9 | ||

| + | |- | ||

| + | |||

| + | |} | ||

| + | |||

| + | Game Development Meetups & Groups: | ||

| + | *[https://twitter.com/Game_Bridge Game Bridge] (Middlesbrough) | ||

| + | *[https://www.womenmakinggames.com/ Women Making Games North East] (North East) | ||

| + | |||

| + | Key Facts: | ||

| + | *Major international games companies have offices in Newcastle and Sunderland. | ||

| + | *The region also has a higher proportion of games companies with 5-24 employees than any other. | ||

| + | *The north east ranks 2nd only to London for productivity | ||

| + | |||

| + | === Yorkshire and The Humber === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !Location | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£m) | ||

| + | !Total GVA (£m) | ||

| + | |- | ||

| + | |Leeds | ||

| + | |27 | ||

| + | |187 | ||

| + | |6.4 | ||

| + | |11.2 | ||

| + | |- | ||

| + | |Sheffield | ||

| + | |43 | ||

| + | |331 | ||

| + | |9.9 | ||

| + | |17.3 | ||

| + | |- | ||

| + | |Wakefield and Castleford | ||

| + | |7 | ||

| + | |92 | ||

| + | |1.6 | ||

| + | |2.8 | ||

| + | |- | ||

| + | |York | ||

| + | |14 | ||

| + | |30 | ||

| + | |1.2 | ||

| + | |2.0 | ||

| + | |- | ||

| + | !Yorkshire and the Humber | ||

| + | |149 | ||

| + | |767 | ||

| + | |24.5 | ||

| + | |42.9 | ||

| + | |||

| + | |} | ||

| + | |||

| + | Game Development Meetups & Groups: | ||

| + | *[http://xixs.com/badonkadonk Badonkadonk] (Bradford) | ||

| + | *[https://twitter.com/Ga_Ma_Yo Ga-Ma-Yo] (Yorkshire) | ||

| + | *[http://gamerepublic.net/ Game Republic] (Yorkshire) | ||

| + | *[https://twitter.com/HumberBundle HumberBundle] (Hull) | ||

| + | *[https://twitter.com/LeedsGamesToast Leeds Games Toast] (Leeds) | ||

| + | *[http://shindigdev.com/ Shindig] (Sheffield) | ||

| + | |||

| + | Key Facts: | ||

| + | *Games companies employing large numbers of people operate in Leeds, Sheffield and Wakefield. | ||

| + | *Companies in Wakefield and Sheffield in particular provide major economic value when compared with other sectors | ||

| + | |||

| + | === West Midlands === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !Location | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£m) | ||

| + | !Total GVA (£m) | ||

| + | |- | ||

| + | |Birmingham | ||

| + | |35 | ||

| + | |86 | ||

| + | |4.6 | ||

| + | |8.0 | ||

| + | |- | ||

| + | |Leamington Spa | ||

| + | |34 | ||

| + | |907 | ||

| + | |57.4 | ||

| + | |100.7 | ||

| + | |- | ||

| + | !West Midlands | ||

| + | |134 | ||

| + | |1209 | ||

| + | |74.6 | ||

| + | |130.8 | ||

| + | |- | ||

| + | |||

| + | |} | ||

| + | |||

| + | Game Development Meetups & Groups: | ||

| + | *[https://www.meetup.com/brumindies/ Brum Indies] (Birmingham) | ||

| + | *[http://archcreatives.com/ Leamingston Spa: Arch Creatives] (Leamington Spa) | ||

| + | *[https://www.meetup.com/Leamington-Unity-Developers/ Leamington Unity Developers] (Leamington Spa) | ||

| + | |||

| + | Key Facts: | ||

| + | *Games companies in Leamington Spa in particular provide major economic value to the West Midlands. | ||

| + | *The town is ranked 1st for economic contribution provided by games companies in proportion to other industries | ||

| + | |||

| + | === East Midlands === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !Location | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£m) | ||

| + | !Total GVA (£m) | ||

| + | |- | ||

| + | |Burton Upon Trent | ||

| + | |8 | ||

| + | |113 | ||

| + | |9.7 | ||

| + | |17.0 | ||

| + | |- | ||

| + | |Derby | ||

| + | |11 | ||

| + | |46 | ||

| + | |2.6 | ||

| + | |4.6 | ||

| + | |- | ||

| + | |Lincoln | ||

| + | |8 | ||

| + | |328 | ||

| + | |15.3 | ||

| + | |26.7 | ||

| + | |- | ||

| + | |Nottingham | ||

| + | |31 | ||

| + | |194 | ||

| + | |10.6 | ||

| + | |18.5 | ||

| + | |- | ||

| + | !East Midlands | ||

| + | |95 | ||

| + | |906 | ||

| + | |42.3 | ||

| + | |74.1 | ||

| + | |||

| + | |} | ||

| + | |||

| + | Game Development Meetups & Groups: | ||

| + | *[https://www.facebook.com/groups/EastMidlandsIndies East Midlands Indies] (Nottingham) | ||

| + | |||

| + | Key Facts: | ||

| + | *Large, prestigious games companies are operating in Twycross, Lincoln and Nottingham | ||

| + | *Around 900 games workers in total are employed in the East Midlands | ||

| + | |||

| + | === East of England === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !Location | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£m) | ||

| + | !Total GVA (£m) | ||

| + | |- | ||

| + | |Cambridge | ||

| + | |47 | ||

| + | |853 | ||

| + | |16.4 | ||

| + | |28.7 | ||

| + | |- | ||

| + | |Chelmsford | ||

| + | |10 | ||

| + | |26 | ||

| + | |1.4 | ||

| + | |2.4 | ||

| + | |- | ||

| + | !East of England | ||

| + | |166 | ||

| + | |1209 | ||

| + | |30.9 | ||

| + | |54.3 | ||

| + | |- | ||

| + | |||

| + | |} | ||

| + | |||

| + | Game Development Meetups & Groups: | ||

| + | *[https://www.meetup.com/Cambridge-Game-Creators/ Cambridge Game Creators] (Cambridge) | ||

| + | *[https://twitter.com/cambridgeindies Cambridge Indies] (Cambridge) | ||

| + | *[https://www.meetup.com/NorfolkIndieGameDevelopers/ Norfolk Indie Game Developers] (Norfolk) | ||

| + | |||

| + | Key Facts: | ||

| + | *There are around 1,200 games jobs in the East of England. | ||

| + | *Cambridge ranks 1st by number of game jobs per capita. | ||

| + | |||

| + | === London === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !Location | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£m) | ||

| + | !Total GVA (£m) | ||

| + | |- | ||

| + | !London | ||

| + | |588 | ||

| + | |5107 | ||

| + | |729.2 | ||

| + | |1390.2 | ||

| + | |||

| + | |} | ||

| + | |||

| + | Game Development Meetups & Groups: | ||

| + | *[http://weatherfactory.biz/coven-club/ Coven Club] | ||

| + | *[http://www.londonindies.com/ London Indies] | ||

| + | *[https://www.meetup.com/London-Unreal-Engine-Meetup/ London Unreal Engine Meetup] | ||

| + | |||

| + | Key Facts: | ||

| + | *There are over 580 active games companies in London | ||

| + | *The games industry in London contributes over £1.3bn of value to the economy | ||

| + | *Over 5,000 people in the capital work in games | ||

| + | *Around 2% of all creative sector workers in London work in games | ||

| + | |||

| + | === South West === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !Location | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£m) | ||

| + | !Total GVA (£m) | ||

| + | |- | ||

| + | |Falmouth | ||

| + | |5 | ||

| + | |27 | ||

| + | |1.5 | ||

| + | |2.6 | ||

| + | |- | ||

| + | |Bristol | ||

| + | |46 | ||

| + | |139 | ||

| + | |5.5 | ||

| + | |9.7 | ||

| + | |- | ||

| + | !South West | ||

| + | |152 | ||

| + | |423 | ||

| + | |18.5 | ||

| + | |32.5 | ||

| + | |- | ||

| + | |||

| + | |} | ||

| + | |||

| + | Game Development Meetups & Groups: | ||

| + | *[https://bristolgameshub.com/ Bristol Games Hub] (Bristol) | ||

| + | |||

| + | Key Facts: | ||

| + | *Though there are no major multinational publishers or developers based in the South West, the region is still home to over 150 games companies | ||

| + | |||

| + | === South East === | ||

| + | |||

| + | {| class="wikitable" | ||

| + | !Location | ||

| + | !Games Companies | ||

| + | !Full-Time Employees | ||

| + | !Direct GVA (£m) | ||

| + | !Total GVA (£m) | ||

| + | |- | ||

| + | |Basingstoke | ||

| + | |12 | ||

| + | |88 | ||

| + | |1.3 | ||

| + | |2.2 | ||

| + | |- | ||

| + | |Brighton | ||

| + | |65 | ||

| + | |277 | ||

| + | |13.7 | ||

| + | |24.1 | ||

| + | |- | ||

| + | |Crawley and Horsham | ||

| + | |24 | ||

| + | |579 | ||

| + | |47.8 | ||

| + | |83.7 | ||

| + | |- | ||

| + | |Guildford and Aldershot | ||

| + | |64 | ||

| + | |855 | ||

| + | |36.6 | ||

| + | |64.0 | ||

| + | |- | ||

| + | |Oxford | ||

| + | |26 | ||

| + | |312 | ||

| + | |8.0 | ||

| + | |14.4 | ||

| + | |- | ||

| + | |Medway | ||

| + | |4 | ||

| + | |146 | ||

| + | |12.3 | ||

| + | |21.6 | ||

| + | |- | ||

| + | |Milton Keynes | ||

| + | |5 | ||

| + | |95 | ||

| + | |9.5 | ||

| + | |17.7 | ||

| + | |- | ||

| + | |Reading | ||

| + | |14 | ||

| + | |162 | ||

| + | |4.8 | ||

| + | |8.5 | ||

| + | |- | ||

| + | |Slough and Heathrow | ||

| + | |62 | ||

| + | |595 | ||

| + | |58.8 | ||

| + | |116.2 | ||

| + | |- | ||

| + | !South East | ||

| + | |376 | ||

| + | |3266 | ||

| + | |197.3 | ||

| + | |356.3 | ||

| + | |||

| + | |} | ||

| + | |||

| + | Game Development Meetups & Groups: | ||

| + | *[http://brightongamecollective.com/ Brighton Game Collective] (Brighton) | ||

| + | *[https://twitter.com/brightonindies Brighton Indies] (Brighton) | ||

| + | *[https://www.meetup.com/Brighton-Unity-Group/ Brighton Unity Group] (Brighton) | ||

| + | *[https://www.facebook.com/groups/584711874962051/ Guildford Game Developers] (Guildford) | ||

| + | *[http://oxfordindies.co.uk/ Oxford Indies] (Oxford) | ||

| + | |||

| + | Key Facts: | ||

| + | *There are over 370 active games companies in the South East | ||

| + | *Over 3,200 people in the South East are employed in the games industry. | ||

| + | *Locations such as Guildford, Oxford and Brighton have some of the largest games companies in the UK | ||

| + | |||

| + | == Previous Reports == | ||

| + | |||

| + | === 2018 Stats === | ||

| + | |||

| + | *As of October 2018 there were 2,277 active games companies in the UK ([https://gamesmap.uk UK Games Map]) | ||

| + | *The map also listed 151 games industry service companies and 231 games-related courses across 102 universities and academic institutions in 2018. ([https://gamesmap.uk UK Games Map]) | ||

| + | |||

| + | *The creative industries contributed a record £101.5bn in GVA to the UK economy in 2017, and in crease of 7.1% on the previous year. ([https://www.gov.uk/government/statistics/dcms-sectors-economic-estimates-2017-gva DCMS], Nov 2018) | ||

| + | *Overall in 2016, the UK games industry provided 47,620 FTE jobs and contibuted £2.87bn in GVA to the UK economy. ([https://www.bfi.org.uk/education-research/film-industry-statistics-research/reports/uk-film-economy Olsberg SPI / BFI], Oct 2018) | ||

| + | *The UK games industry directly employs 20,430 FTEs in development, publishing and retail roles, which contibute £1.52bn in direct GVA to the economy. ([https://www.bfi.org.uk/education-research/film-industry-statistics-research/reports/uk-film-economy Olsberg SPI / BFI], Oct 2018) | ||

| + | {| class="wikitable" | ||

| + | |'''Subsector''' | ||

| + | |'''Employment (FTEs)''' | ||

| + | |'''GVA (£m)''' | ||

| + | |- | ||

| + | |Publishing | ||

| + | |2,300 | ||

| + | |526.6 | ||

| + | |- | ||

| + | |Digital Retail | ||

| + | |310 | ||

| + | |31.7 | ||

| + | |- | ||

| + | |Physical Retail | ||

| + | |3,980 | ||

| + | |132.0 | ||

| + | |- | ||

| + | |'''Total''' | ||

| + | |'''20,430''' | ||

| + | |'''1.52''' | ||

| + | |} | ||

| + | |||

| + | *The economic impact of the growing UK Esports sector was also assessed for the first time and was shown to have supported 470 FTE jobs and contributed £18.4m in GVA in 2016. ([https://www.bfi.org.uk/education-research/film-industry-statistics-research/reports/uk-film-economy Olsberg SPI / BFI], Oct 2018) | ||

| + | |||

| + | *In 2016, the UK games industry spent £1.25bn on game development. ([https://www.bfi.org.uk/education-research/film-industry-statistics-research/reports/uk-film-economy Olsberg SPI / BFI], Oct 2018) | ||

| + | |||

| + | *In the period 2015-2017, there was at least £1.75bn of inward investment in the UK games industry. ([https://www.bfi.org.uk/education-research/film-industry-statistics-research/reports/uk-film-economy Olsberg SPI / BFI], Oct 2018) | ||

| + | |||

| + | *The VGTR supports 9,240 FTE jobs across the UK games industry, including 4,320 directly in development roles (31% of the total UK development workforce). ([https://www.bfi.org.uk/education-research/film-industry-statistics-research/reports/uk-film-economy Olsberg SPI / BFI], Oct 2018) | ||

| + | |||

| + | *VGTR games represented £389.9m of UK development spend, 31% of the total development spend. Overall, projects supported by the VGTR contibuted£525m in GVA to the UK economy and £158m in tax revenue. ([https://www.bfi.org.uk/education-research/film-industry-statistics-research/reports/uk-film-economy Olsberg SPI / BFI], Oct 2018) | ||

| + | |||

| + | *68% of VGTR-supported games would not be made in the UK, or at all, without the relief in place. ([https://www.bfi.org.uk/education-research/film-industry-statistics-research/reports/uk-film-economy Olsberg SPI / BFI], Oct 2018) | ||

| + | |||

| + | *For every £1 the Government invested into the games sector via VGTR, an additional £4 in GVA was generated for the UK economy. ([https://www.bfi.org.uk/education-research/film-industry-statistics-research/reports/uk-film-economy Olsberg SPI / BFI], Oct 2018) | ||

| + | |||

| + | *Of all the screen sector tax reliefs, the games sector was shown to have the highest rate of productivity, where each employee generated an average of £83,800 in GVA for the economy, significantly above the national industrial average of £62,100. ([https://www.bfi.org.uk/education-research/film-industry-statistics-research/reports/uk-film-economy Olsberg SPI / BFI], Oct 2018) | ||

| + | |||

| + | *In November 2018 there were 5.7m professional developers in Europe, up by 200,000 on 2017. This compares to the 4.4m in the US, which has that stayed flat year on year. The UK is home to 830,500 professional developers. ([https://2018.stateofeuropeantech.com/ Atomico], Dec 2018) | ||

| + | |||

| + | *In 2018, The UK was the No.1 European destination for international movers in the tech ecosystem, accounting for 20.9% of all international movers. ([https://2018.stateofeuropeantech.com/ Atomico], Dec 2018) | ||

| + | |||

| + | *44% of founders and employees of private tech start-ups in the UK and Ireland are migrants, the highest percentage of any European region. ([https://2018.stateofeuropeantech.com/ Atomico], Dec 2018) | ||

| + | |||

| + | *Valve’s Steam platform's top 100 highest grossing games of 2017 list featured 15 games made or partly made in the UK, including two games in the top “platinum tier”, one in the gold tier and four in silver. ([http://ukie.org.uk/news/2018/01/strong-showing-uk-made-games-steams-biggest-games-2017 Steam / Ukie], Jan 2018) | ||

| + | |||

| + | *Valve’s Steam platform's top 92 games by peak simultaneous players featured 14 games made or partly made in the UK (15.2%), including Rockstar’s ‘Grand Theft Auto V’ in the top "over 100k simultaneous players" tier and six games from the UK (or 40%) in the second "over 50k players" tier. ([http://ukie.org.uk/news/2018/01/strong-showing-uk-made-games-steams-biggest-games-2017 Steam / Ukie], Jan 2018) | ||

| + | |||

| + | *Valve’s Steam platforms top 10 highest grossing VR games featured 11 games made in the UK, including one game partly made in the UK in the top “platinum” tier, one UK-made game in the gold tier and four in silver. ([http://ukie.org.uk/news/2018/01/strong-showing-uk-made-games-steams-biggest-games-2017 Steam / Ukie], Jan 2018) | ||

| + | |||

| + | === 2017 Stats === | ||

| + | |||

| + | *In 2017, the UK has been ranked as third best country in the world for the ability to attract, retain, train and educate skilled workers, according to the Global Talent Competitiveness Index ([http://www.onrec.com/news/news-archive/uk-ranks-third-in-global-talent-competitiveness-ranking INSEAD], Jan 2017) | ||

| − | + | *London, Birmingham and Cardiff act as talent magnets, helping the UK attract more highly-skilled workers. In 2017 Cardiff was the 11th best city worldwide at attracting, growing and retaining talent, with London listed 16th and Birmingham 17th. ([http://www.onrec.com/news/news-archive/uk-ranks-third-in-global-talent-competitiveness-ranking INSEAD], Jan 2017) | |

| − | == | + | === 2016 Stats === |

| − | + | *As of 2016, only 41% of UK games companies were using the correct Standard Industrial Classification codes. ([https://gamesmap.uk UK Games Map] Oct 2016) | |

| + | *As of 2016, 68% of UK games companies had been founded since the beginning of 2010. ([https://gamesmap.uk UK Games Map] Oct 2016) | ||

| − | = | + | *In 2016, European games industry professionals rated the UK as the place in Europe where both the best games were made at the time and the best games will be made in five year’s time. ([http://registration.gdceurope.com/GDCEurope-StateOfGame?_mc=blog_x_gdceu_wp_aud_gdceu_x_x-sotieu GDC], Aug 2016) |

| + | *The UK’s creative industries were worth a record £84.1 billion to the UK economy in 2016. The figures show the sector growing at almost twice the rate of the wider UK economy - generating £9.6million per hour. ([https://www.gov.uk/government/news/creative-industries-worth-almost-10-million-an-hour-to-economy Gov.co.uk], Jan 2016) | ||

| − | == | + | === 2015 Stats === |

| − | + | *In 2013, the core UK video games sector (video games made wholly or partially in the UK) supported 12,100 FTEs of direct employment. This is split into 9,400 FTEs in development, 900 in publishing and 1,800 in retail. ([http://www.bfi.org.uk/education-research/film-industry-statistics-reports/reports/uk-film-economy/economic-contribution-uks-film-sectors BFI], Feb 2015) | |

| − | + | *In 2013, the core UK video games sector (video games made wholly or partially in the UK) contributed £755m in direct GVA. This is split into £639.1m in development, £63.3m in publishing and £53m in retail. ([http://www.bfi.org.uk/education-research/film-industry-statistics-reports/reports/uk-film-economy/economic-contribution-uks-film-sectors BFI], Feb 2015) | |

| − | + | *In 2013, taking into account the total economic contribution (including multiplier and spillover effects) the core UK video games sector (video games made wholly or partially in the UK) supported 23,900 FTEs of employment, generated £1.4bn in GVA and contributed £429m to the Exchequer. ([http://www.bfi.org.uk/education-research/film-industry-statistics-reports/reports/uk-film-economy/economic-contribution-uks-film-sectors BFI], Feb 2015) | |

| − | + | *When looking at regional distribution of employment in 2013: for development most FTEs were in London (27%), the South East (21%), the East of England (10%) and West Midlands (10%). For publishing most FTEs were in the South East (32%), London (31%), the East of England (18%) and West Midlands (7%). ([http://www.bfi.org.uk/education-research/film-industry-statistics-reports/reports/uk-film-economy/economic-contribution-uks-film-sectors BFI], Feb 2015) | |

Latest revision as of 13:29, 11 May 2021

Contents

- 1 Think Global, Create Local

- 1.1 Summary

- 1.2 About this report

- 1.3 Key Findings

- 1.4 Gross Value Added

- 1.5 Regions with the Highest GVA from Games Companies

- 1.6 Travel to Work Areas with the Highest GVA from Games Companies

- 1.7 Scotland

- 1.8 Wales

- 1.9 Northern Ireland

- 1.10 North West

- 1.11 North East

- 1.12 Yorkshire and The Humber

- 1.13 West Midlands

- 1.14 East Midlands

- 1.15 East of England

- 1.16 London

- 1.17 South West

- 1.18 South East

- 2 Previous Reports

Think Global, Create Local

Summary

Think Global, Create Local is an analysis of the employment and economic impact of the UK games industry across the towns, cities, regions and devolved nations of the UK, released by Ukie in February 2020. It provides new benchmark figures for the number of full-time equivalent jobs (FTEs) and contribution to gross value added (GVA) generated by games companies throughout the country, the impacts of companies of different sizes and comparisons against other sectors.

The full report can be downloaded here: Think Global, Create Local

About this report

The report builds on the findings from the BFI's 'Screen Business' report, released in Ocotber 2018, which showed that the UK games companies directly employed 16,140 FTE roles and collectively generated £2.87bn in GVA.

By applying HM Treasury 'Green Book' principles and best practice economic modelling, 'Screen Business' is the single most authoritative economic analysis of the UK games sector to date. Think Global, Create Local uses the same methodologies to futher explore the same underlying data, ensuring robust results at the highest possible standards. As this means no underlying data could therefore be updated, all results in this report relate to the year 2016 and represent a snapshot in time for our sector. It should also be understood that since 2016, the UK games industry has continued to thrive, and that this report reflects that benchmark from which future growth can be reliably tracked.

Key Findings

- Eight games hubs contributed over £60m in GVA to their local economies: Edinburgh, Newcastle Upon Tyne, Leamington Spa, Crawley and Horsham, Manchester, Guildford, Slough and Heathrow, and London.

- 55% of game development roles are based outside of London and the South East.

- The North West, East of England, West Midlands, Scotland and the South East all employ over 1,000 FTEs in development studio roles.

- London's game sector is a billion pound industry, generating £1.4bn in GVA for the economy and directly employing over 5,100 FTE roles.

- 23 towns and cities across the UK are home to more than 20 local game companies.

- Scotland is home to a thriving games industry, with three major hubs generating £131m in GVA for the nation.

- The North East games industry has the biggest impact on the local economy outside of London, contributing £1.90 of every £1,000 of regional GVA.

- 99.5% of UK games companies are officially SMEs (Small to Medium Enterprises, employing less than 250 people), which collectively contribute £1.6bn in GVA.

- £339m in GVA is generated by micro-businesses of less than 10 employees, representing 13.7% of the industry total, and employing 3,664 FTEs.

- The very largest games companies, each employing over 250 people, are hugely important to the UK economy, alone contributing £840m in GVA and employing over 4,200 FTEs, or 26% of the industry workforce.

Gross Value Added

Gross value added (GVA) is the measure of the economic value of goods and services. This can be used to compare the economic impact of different sectors or compare the impact of the same sector in different geographic areas. All measures of GVA in this article relate to data originally from the BFI's Screen Business Report (October 2018). The methodology of this report explains how direct and total GVA figures are calculated.

Regions with the Highest GVA from Games Companies

| Region | Games Companies | Full-Time Employees | Direct GVA (£M) | Total GVA (£M) |

|---|---|---|---|---|

| London | 588 | 5107 | 729.2 | 1390.2 |

| South East | 376 | 3266 | 197.3 | 356.3 |

| North West | 174 | 1315 | 89.9 | 157.3 |

| Scotland | 113 | 1156 | 75.0 | 131.2 |

| West Midlands | 134 | 1209 | 74.6 | 130.8 |

| North East | 52 | 518 | 56.7 | 99.9 |

| East Midlands | 95 | 906 | 42.3 | 74.1 |

| East of England | 166 | 1209 | 30.9 | 54.3 |

| Yorkshire and the Humber | 149 | 767 | 24.5 | 42.9 |

| South West | 152 | 423 | 18.5 | 32.5 |

| Wales | 54 | 172 | 8.2 | 14.4 |

| Northern Ireland | 35 | 77 | 3.2 | 5.6 |

Travel to Work Areas with the Highest GVA from Games Companies

A travel to work area (TTWA) is a UK Government statistical tool used to indicate an area where a significant proportion of the population commute to a larger town or city for work. TTWAs where games companies provide high levels of economic value can be found throughout the UK, as shown in the below table:

| TTWA | Games Companies | Full-Time Employees | Direct GVA (£M) | Total GVA (£M) |

|---|---|---|---|---|

| London | 573 | 4980 | 715.4 | 1362 |

| Slough and Heathrow | 62 | 595 | 58.8 | 116.2 |

| Leamington Spa | 34 | 907 | 57.4 | 100.7 |

| Newcastle upon Tyne | 20 | 372 | 48.6 | 85.8 |

| Crawley (incl. Horsham) | 24 | 579 | 47.8 | 83.7 |

| Edinburgh | 32 | 657 | 45.9 | 80.3 |

| Manchester | 82 | 369 | 37.7 | 66.1 |

| Guildford and Aldershot | 64 | 855 | 36.6 | 64.0 |

| Liverpool | 35 | 152 | 21.7 | 38.0 |

| Dundee | 33 | 306 | 17.6 | 30.9 |

| Cambridge | 47 | 853 | 16.4 | 28.7 |

| Crewe (incl. Knutsford) | 8 | 558 | 16.4 | 28.6 |

| Lincoln | 8 | 328 | 15.3 | 26.7 |

| Brighton | 65 | 277 | 13.7 | 24.1 |

| Medway | 4 | 146 | 12.3 | 21.6 |

| Nottingham | 31 | 194 | 10.6 | 18.5 |

| Milton Keynes | 17 | 95 | 9.5 | 17.7 |

| Sheffield | 43 | 331 | 9.9 | 17.3 |

| Burton upon Trent (incl. Twycross) | 8 | 113 | 9.7 | 17.0 |

| Oxford | 26 | 312 | 8.0 | 14.4 |

Scotland

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Dundee | 33 | 306 | 17.6 | 30.9 |

| Edinburgh | 32 | 657 | 45.9 | 80.3 |

| Glasgow | 38 | 116 | 7.2 | 12.5 |

| Scotland | 133 | 1156 | 75.0 | 131.2 |

Game Development Meetups & Groups:

- Game Dev Ed (Edinburgh)

- IGDA Scotland (Scotland)

- Scottish Games (Scotland)

- InGAME (Dundee)

Key Facts:

- Around three quarters of Scottish games companies are based in Edinburgh, Dundee or Glasgow.

- There are however, small games companies throughout the rest of Scotland

Wales

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Bridgend | 5 | 53 | 3.0 | 5.2 |

| Cardiff | 26 | 66 | 2.7 | 4.8 |

| Wales | 54 | 172 | 8.2 | 14.4 |

Game Development Meetups & Groups:

Key Facts:

- Around half of games companies in Wales are based in Cardiff, with the remaining other half operating throughout the rest of the country.

- Games companies provide a higher proportion of overall GVA in Bridgend than in any other Welsh town or city.

Northern Ireland

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Belfast | 21 | 48 | 2.0 | 3.5 |

| Northern Ireland | 35 | 77 | 3.2 | 5.6 |

Game Development Meetups & Groups:

Key Facts:

- 5 of Northern Ireland’s 6 counties have games companies operating in them.

- The majority of games companies in Northern Ireland are in Belfast

North West

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Crewe | 8 | 558 | 16.4 | 28.6 |

| Liverpool | 35 | 152 | 21.7 | 38.0 |

| Manchester | 82 | 369 | 37.7 | 66.1 |

| North West | 174 | 1315 | 89.9 | 157.3 |

Game Development Meetups & Groups:

- Gamedev Liverpool (Liverpool)

- Gameopolis (Greater Manchester)

- Liverpool Games Cluster (Liverpool)

- WA Games (Warrington)

Key Facts:

- Crewe, Liverpool and Manchester are hubs for games development.

- With around 1,300 games industry jobs in the north west, the region comes 3rd for number of games jobs

- The region also comes 3rd for total GVA from the industry

North East

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Newcastle upon Tyne | 20 | 372 | 48.6 | 85.8 |

| Sunderland | 12 | 84 | 3.0 | 5.3 |

| North East | 52 | 518 | 56.7 | 99.9 |

Game Development Meetups & Groups:

- Game Bridge (Middlesbrough)

- Women Making Games North East (North East)

Key Facts:

- Major international games companies have offices in Newcastle and Sunderland.

- The region also has a higher proportion of games companies with 5-24 employees than any other.

- The north east ranks 2nd only to London for productivity

Yorkshire and The Humber

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Leeds | 27 | 187 | 6.4 | 11.2 |

| Sheffield | 43 | 331 | 9.9 | 17.3 |

| Wakefield and Castleford | 7 | 92 | 1.6 | 2.8 |

| York | 14 | 30 | 1.2 | 2.0 |

| Yorkshire and the Humber | 149 | 767 | 24.5 | 42.9 |

Game Development Meetups & Groups:

- Badonkadonk (Bradford)

- Ga-Ma-Yo (Yorkshire)

- Game Republic (Yorkshire)

- HumberBundle (Hull)

- Leeds Games Toast (Leeds)

- Shindig (Sheffield)

Key Facts:

- Games companies employing large numbers of people operate in Leeds, Sheffield and Wakefield.

- Companies in Wakefield and Sheffield in particular provide major economic value when compared with other sectors

West Midlands

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Birmingham | 35 | 86 | 4.6 | 8.0 |

| Leamington Spa | 34 | 907 | 57.4 | 100.7 |

| West Midlands | 134 | 1209 | 74.6 | 130.8 |

Game Development Meetups & Groups:

- Brum Indies (Birmingham)

- Leamingston Spa: Arch Creatives (Leamington Spa)

- Leamington Unity Developers (Leamington Spa)

Key Facts:

- Games companies in Leamington Spa in particular provide major economic value to the West Midlands.

- The town is ranked 1st for economic contribution provided by games companies in proportion to other industries

East Midlands

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Burton Upon Trent | 8 | 113 | 9.7 | 17.0 |

| Derby | 11 | 46 | 2.6 | 4.6 |

| Lincoln | 8 | 328 | 15.3 | 26.7 |

| Nottingham | 31 | 194 | 10.6 | 18.5 |

| East Midlands | 95 | 906 | 42.3 | 74.1 |

Game Development Meetups & Groups:

- East Midlands Indies (Nottingham)

Key Facts:

- Large, prestigious games companies are operating in Twycross, Lincoln and Nottingham

- Around 900 games workers in total are employed in the East Midlands

East of England

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Cambridge | 47 | 853 | 16.4 | 28.7 |

| Chelmsford | 10 | 26 | 1.4 | 2.4 |

| East of England | 166 | 1209 | 30.9 | 54.3 |

Game Development Meetups & Groups:

- Cambridge Game Creators (Cambridge)

- Cambridge Indies (Cambridge)

- Norfolk Indie Game Developers (Norfolk)

Key Facts:

- There are around 1,200 games jobs in the East of England.

- Cambridge ranks 1st by number of game jobs per capita.

London

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| London | 588 | 5107 | 729.2 | 1390.2 |

Game Development Meetups & Groups:

Key Facts:

- There are over 580 active games companies in London

- The games industry in London contributes over £1.3bn of value to the economy

- Over 5,000 people in the capital work in games

- Around 2% of all creative sector workers in London work in games

South West

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Falmouth | 5 | 27 | 1.5 | 2.6 |

| Bristol | 46 | 139 | 5.5 | 9.7 |

| South West | 152 | 423 | 18.5 | 32.5 |

Game Development Meetups & Groups:

- Bristol Games Hub (Bristol)

Key Facts:

- Though there are no major multinational publishers or developers based in the South West, the region is still home to over 150 games companies

South East

| Location | Games Companies | Full-Time Employees | Direct GVA (£m) | Total GVA (£m) |

|---|---|---|---|---|

| Basingstoke | 12 | 88 | 1.3 | 2.2 |

| Brighton | 65 | 277 | 13.7 | 24.1 |

| Crawley and Horsham | 24 | 579 | 47.8 | 83.7 |

| Guildford and Aldershot | 64 | 855 | 36.6 | 64.0 |

| Oxford | 26 | 312 | 8.0 | 14.4 |

| Medway | 4 | 146 | 12.3 | 21.6 |

| Milton Keynes | 5 | 95 | 9.5 | 17.7 |

| Reading | 14 | 162 | 4.8 | 8.5 |

| Slough and Heathrow | 62 | 595 | 58.8 | 116.2 |

| South East | 376 | 3266 | 197.3 | 356.3 |

Game Development Meetups & Groups:

- Brighton Game Collective (Brighton)

- Brighton Indies (Brighton)

- Brighton Unity Group (Brighton)

- Guildford Game Developers (Guildford)

- Oxford Indies (Oxford)

Key Facts:

- There are over 370 active games companies in the South East

- Over 3,200 people in the South East are employed in the games industry.

- Locations such as Guildford, Oxford and Brighton have some of the largest games companies in the UK

Previous Reports

2018 Stats

- As of October 2018 there were 2,277 active games companies in the UK (UK Games Map)

- The map also listed 151 games industry service companies and 231 games-related courses across 102 universities and academic institutions in 2018. (UK Games Map)

- The creative industries contributed a record £101.5bn in GVA to the UK economy in 2017, and in crease of 7.1% on the previous year. (DCMS, Nov 2018)

- Overall in 2016, the UK games industry provided 47,620 FTE jobs and contibuted £2.87bn in GVA to the UK economy. (Olsberg SPI / BFI, Oct 2018)

- The UK games industry directly employs 20,430 FTEs in development, publishing and retail roles, which contibute £1.52bn in direct GVA to the economy. (Olsberg SPI / BFI, Oct 2018)

| Subsector | Employment (FTEs) | GVA (£m) |

| Publishing | 2,300 | 526.6 |

| Digital Retail | 310 | 31.7 |

| Physical Retail | 3,980 | 132.0 |

| Total | 20,430 | 1.52 |

- The economic impact of the growing UK Esports sector was also assessed for the first time and was shown to have supported 470 FTE jobs and contributed £18.4m in GVA in 2016. (Olsberg SPI / BFI, Oct 2018)

- In 2016, the UK games industry spent £1.25bn on game development. (Olsberg SPI / BFI, Oct 2018)

- In the period 2015-2017, there was at least £1.75bn of inward investment in the UK games industry. (Olsberg SPI / BFI, Oct 2018)

- The VGTR supports 9,240 FTE jobs across the UK games industry, including 4,320 directly in development roles (31% of the total UK development workforce). (Olsberg SPI / BFI, Oct 2018)

- VGTR games represented £389.9m of UK development spend, 31% of the total development spend. Overall, projects supported by the VGTR contibuted£525m in GVA to the UK economy and £158m in tax revenue. (Olsberg SPI / BFI, Oct 2018)

- 68% of VGTR-supported games would not be made in the UK, or at all, without the relief in place. (Olsberg SPI / BFI, Oct 2018)

- For every £1 the Government invested into the games sector via VGTR, an additional £4 in GVA was generated for the UK economy. (Olsberg SPI / BFI, Oct 2018)

- Of all the screen sector tax reliefs, the games sector was shown to have the highest rate of productivity, where each employee generated an average of £83,800 in GVA for the economy, significantly above the national industrial average of £62,100. (Olsberg SPI / BFI, Oct 2018)

- In November 2018 there were 5.7m professional developers in Europe, up by 200,000 on 2017. This compares to the 4.4m in the US, which has that stayed flat year on year. The UK is home to 830,500 professional developers. (Atomico, Dec 2018)

- In 2018, The UK was the No.1 European destination for international movers in the tech ecosystem, accounting for 20.9% of all international movers. (Atomico, Dec 2018)

- 44% of founders and employees of private tech start-ups in the UK and Ireland are migrants, the highest percentage of any European region. (Atomico, Dec 2018)

- Valve’s Steam platform's top 100 highest grossing games of 2017 list featured 15 games made or partly made in the UK, including two games in the top “platinum tier”, one in the gold tier and four in silver. (Steam / Ukie, Jan 2018)

- Valve’s Steam platform's top 92 games by peak simultaneous players featured 14 games made or partly made in the UK (15.2%), including Rockstar’s ‘Grand Theft Auto V’ in the top "over 100k simultaneous players" tier and six games from the UK (or 40%) in the second "over 50k players" tier. (Steam / Ukie, Jan 2018)

- Valve’s Steam platforms top 10 highest grossing VR games featured 11 games made in the UK, including one game partly made in the UK in the top “platinum” tier, one UK-made game in the gold tier and four in silver. (Steam / Ukie, Jan 2018)

2017 Stats

- In 2017, the UK has been ranked as third best country in the world for the ability to attract, retain, train and educate skilled workers, according to the Global Talent Competitiveness Index (INSEAD, Jan 2017)

- London, Birmingham and Cardiff act as talent magnets, helping the UK attract more highly-skilled workers. In 2017 Cardiff was the 11th best city worldwide at attracting, growing and retaining talent, with London listed 16th and Birmingham 17th. (INSEAD, Jan 2017)

2016 Stats

- As of 2016, only 41% of UK games companies were using the correct Standard Industrial Classification codes. (UK Games Map Oct 2016)

- As of 2016, 68% of UK games companies had been founded since the beginning of 2010. (UK Games Map Oct 2016)

- In 2016, European games industry professionals rated the UK as the place in Europe where both the best games were made at the time and the best games will be made in five year’s time. (GDC, Aug 2016)

- The UK’s creative industries were worth a record £84.1 billion to the UK economy in 2016. The figures show the sector growing at almost twice the rate of the wider UK economy - generating £9.6million per hour. (Gov.co.uk, Jan 2016)

2015 Stats

- In 2013, the core UK video games sector (video games made wholly or partially in the UK) supported 12,100 FTEs of direct employment. This is split into 9,400 FTEs in development, 900 in publishing and 1,800 in retail. (BFI, Feb 2015)

- In 2013, the core UK video games sector (video games made wholly or partially in the UK) contributed £755m in direct GVA. This is split into £639.1m in development, £63.3m in publishing and £53m in retail. (BFI, Feb 2015)

- In 2013, taking into account the total economic contribution (including multiplier and spillover effects) the core UK video games sector (video games made wholly or partially in the UK) supported 23,900 FTEs of employment, generated £1.4bn in GVA and contributed £429m to the Exchequer. (BFI, Feb 2015)

- When looking at regional distribution of employment in 2013: for development most FTEs were in London (27%), the South East (21%), the East of England (10%) and West Midlands (10%). For publishing most FTEs were in the South East (32%), London (31%), the East of England (18%) and West Midlands (7%). (BFI, Feb 2015)