Difference between revisions of "2018 UK Consumer Games Market Valuation"

(→2018 Valuation) |

(→Game Culture) |

||

| (4 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | [[File: | + | [[File:Ukie_2018_UK_Games_Market_Valuation_800px.jpg|thumb|border|400px|Ukie 2018 UK Consumer Games Market Valuation]] |

All figures shown below are those given on the date of publication. Later valuations may have revised the figures for this year. | All figures shown below are those given on the date of publication. Later valuations may have revised the figures for this year. | ||

| Line 8: | Line 8: | ||

2018 was solid growth across the game software and hardware markets, with software revenues eclipsing £4bn for the first time, up +10.3% to £4.01bn. Game hardware saw similar growth, up +10.7% to a new high of £1.57bn. The valuation also included an analysis of consumer spend on wider game-related culture, which generated an additional £109.6m. | 2018 was solid growth across the game software and hardware markets, with software revenues eclipsing £4bn for the first time, up +10.3% to £4.01bn. Game hardware saw similar growth, up +10.7% to a new high of £1.57bn. The valuation also included an analysis of consumer spend on wider game-related culture, which generated an additional £109.6m. | ||

| − | |||

=== Game Software === | === Game Software === | ||

| Line 15: | Line 14: | ||

After 2017’s slight uplift in boxed software, 2018’s physical revenues remained fairly steady, dropping just -2.6% to £770m according to data provided by [http://www.gfk.com/en-gb/ GfK Entertainment]. However, the impact of the expanding digital free-to-play market contributed to a downturn in sales of pre-owned games, dropping -30.8% to £67.9m, data from [https://www.kantarworldpanel.com/en Kantar Worldpanel] showed. | After 2017’s slight uplift in boxed software, 2018’s physical revenues remained fairly steady, dropping just -2.6% to £770m according to data provided by [http://www.gfk.com/en-gb/ GfK Entertainment]. However, the impact of the expanding digital free-to-play market contributed to a downturn in sales of pre-owned games, dropping -30.8% to £67.9m, data from [https://www.kantarworldpanel.com/en Kantar Worldpanel] showed. | ||

| − | |||

=== Game Hardware === | === Game Hardware === | ||

| Line 23: | Line 21: | ||

The nascent VR hardware market saw a more difficult year according to IHS Markit’s analysis, dropping -20.9% to £72m as early adopters await the next generation of headsets. | The nascent VR hardware market saw a more difficult year according to IHS Markit’s analysis, dropping -20.9% to £72m as early adopters await the next generation of headsets. | ||

| − | |||

=== Game Culture === | === Game Culture === | ||

| Line 33: | Line 30: | ||

2018 was a strong year for game-related films and music, with the release of both Tomb Raider and Rampage at the box office and the demand for video game soundtracks lifting revenues +34.0% to £23.6m, according to data from the [http://www.bfi.org.uk/education-research British Film Institute] and [http://www.officialcharts.com/ Official Charts Company]. | 2018 was a strong year for game-related films and music, with the release of both Tomb Raider and Rampage at the box office and the demand for video game soundtracks lifting revenues +34.0% to £23.6m, according to data from the [http://www.bfi.org.uk/education-research British Film Institute] and [http://www.officialcharts.com/ Official Charts Company]. | ||

| − | UK games events and venues ticket sales enjoyed another year of growth, with the success of industry mainstays like EGX and Insomnia joined by major new esports events like Birmingham’s ESL One driving | + | UK games events and venues ticket sales enjoyed another year of growth, with the success of industry mainstays like EGX and Insomnia joined by major new esports events like Birmingham’s ESL One driving sales up +5.5% to £8.9m overall. |

| − | |||

=== Valuation Summary === | === Valuation Summary === | ||

| Line 43: | Line 39: | ||

|'''Categories''' | |'''Categories''' | ||

|'''Data Supplier''' | |'''Data Supplier''' | ||

| − | |||

|'''2017 (£m)''' | |'''2017 (£m)''' | ||

| + | |'''2018 (£m)''' | ||

|'''% Growth''' | |'''% Growth''' | ||

|- | |- | ||

Latest revision as of 16:56, 1 April 2019

All figures shown below are those given on the date of publication. Later valuations may have revised the figures for this year.

Contents

2018 Valuation

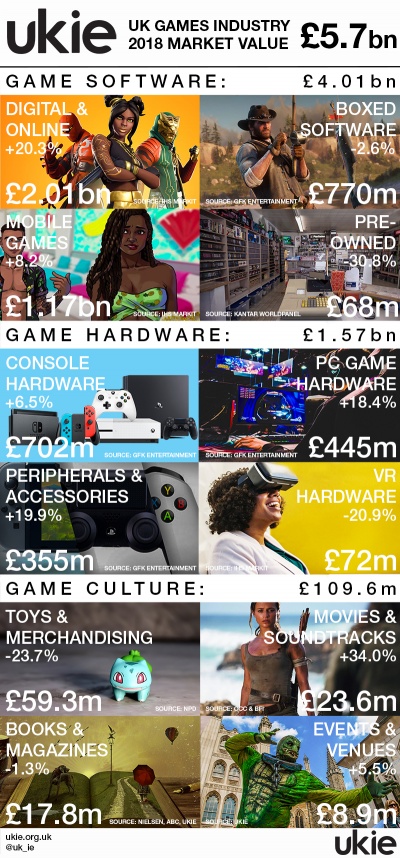

The UK market for games was valued at a record £5.7bn in 2018, representing +10.0% growth on the previous year.

2018 was solid growth across the game software and hardware markets, with software revenues eclipsing £4bn for the first time, up +10.3% to £4.01bn. Game hardware saw similar growth, up +10.7% to a new high of £1.57bn. The valuation also included an analysis of consumer spend on wider game-related culture, which generated an additional £109.6m.

Game Software

In the software market, data from IHS Markit showed a significant increase in digital and online revenues, up +20.3% to a record £2.01bn. While this figure includes full game downloads, DLC and in-game transactions, the success in 2018 of Battle Royale games like PlayerUnknown’s Battlegrounds and Fortnite have now pushed this segment up to encompass 50% of all UK software revenues. Further analysis from IHS Markit showed a buoyant mobile market, with +8.2% uplift to £1.17bn.

After 2017’s slight uplift in boxed software, 2018’s physical revenues remained fairly steady, dropping just -2.6% to £770m according to data provided by GfK Entertainment. However, the impact of the expanding digital free-to-play market contributed to a downturn in sales of pre-owned games, dropping -30.8% to £67.9m, data from Kantar Worldpanel showed.

Game Hardware

Game hardware continued to be a core driver of consumer spend in 2018, with sales of games consoles enjoying an uplift of +6.5% to £702m, despite no new consoles being launched in the period, data from GfK showed. PC Game Hardware saw another strong year, increasing +18.4% to £445m and the peripherals and accessories market similarly grew +19.9% to £355m, showing that UK consumers have a keen demand for the latest technology in their game set-ups, again according to data from GfK.

The nascent VR hardware market saw a more difficult year according to IHS Markit’s analysis, dropping -20.9% to £72m as early adopters await the next generation of headsets.

Game Culture

With game-related toys and merchandise representing the largest part of the overall game culture valuation, the closure of Toys-R-Us in 2018 has a significant impact on the valuation, with sales down -23.7% to £59.3m, data from NPD showed.

Spend on print media for games remained steady year-on-year, dropping just 1.3% to £17.8m, with Nielsen Bookscan data showing the Fortnite effect was a winner in children’s books and Ukie’s analysis and ABC data showing that the launch of new games magazines like Wireframe and the plethora of one-off magazines available helped buoy the market.

2018 was a strong year for game-related films and music, with the release of both Tomb Raider and Rampage at the box office and the demand for video game soundtracks lifting revenues +34.0% to £23.6m, according to data from the British Film Institute and Official Charts Company.

UK games events and venues ticket sales enjoyed another year of growth, with the success of industry mainstays like EGX and Insomnia joined by major new esports events like Birmingham’s ESL One driving sales up +5.5% to £8.9m overall.

Valuation Summary

The 2018 UK games market consumer spend valuation details in full are as follows:

| Categories | Data Supplier | 2017 (£m) | 2018 (£m) | % Growth |

| Digital & Online | IHS Markit | 1,669.0 | 2,008.0 | +20.3% |

| Boxed Software | GfK Entertainment | 790.5 | 770.0 | -2.6% |

| Mobile Games | IHS Markit | 1,079.0 | 1,167.0 | +8.2% |

| Pre-owned | Kantar Worldpanel | 98.2 | 67.9 | -30.8% |

| Game Software Total | 3,636.7 | 4,012.9 | +10.3% | |

| Console Hardware | GfK Entertainment | 659.3 | 702.0 | +6.5% |

| PC Game Hardware | GfK Entertainment | 376.0 | 445.0 | +18.4% |

| Perhiperals & Accessories | GfK Entertainment | 296.1 | 355.0 | +19.9% |

| VR Hardware | IHS Markit | 91.0 | 72.0 | -20.9% |

| Game Hardware Total | 1,442.3 | 1,574.0 | +10.7% | |

| Toys & Merchandise | NPD | 77.7 | 59.3 | -23.7% |

| Books & Magazines | Nielsen Bookscan / ABC / Ukie | 18.0 | 17.8 | -1.3% |

| Movies & Soundtracks | Official Charts Company / BFI | 17.6 | 23.6 | +34.0% |

| Events & Venues | Ukie | 8.5 | 8.9 | +5.5% |

| Game Culture Total | 121.8 | 109.6 | -10.0% | |

| UK Games Market Total | 5,180.8 | 5,696.5 | +10.0% |